U.S. Initial Unemployment Claims Fall to Pandemic-Era Low

Initial claims for unemployment insurance were 348,000 in the week ended August 14, down from 377,000 in the prior week (revised from 375,000). The four-week moving average decreased to 377,750 from 396,750 in the previous week. The Action Economics Forecast Survey consensus for the latest week was 365,000.

Initial claims for the federal Pandemic Unemployment Assistance (PUA) program edged higher, but by just 5,532 to 109,379 in the August 14 week from 103,847 the week before; the earlier number was revised down slightly from 104,572. This was the third successive rise, but each has been modest. The PUA program provides benefits to individuals who are not eligible for regular state unemployment insurance benefits, such as the self-employed. Given the brief history of this program, these and other COVID-related series are not seasonally adjusted.

Continued weeks claimed for regular state unemployment insurance in the week ended August 7 fell 79,000 to 2.820 million from an upwardly revised 2.899 million in the prior week, originally reported at 2.866 million. In the August 7 week, the associated rate of insured unemployment remained at its pandemic low of 2.1%

Continued weeks claimed in the PUA program increased by 56,881 in the week ended July 31 to 4.878 million,. Continued weeks claimed for PEUC benefits fell 66,081 to 3.786 million, yet another new low since the week ended January 16, 2021. The Pandemic Emergency Unemployment Compensation (PEUC) program covers people who have exhausted their state unemployment insurance benefits.

In the week ended July 31, the total number of all state, federal, PUA and PEUC continued claims was 11.744 million, down 311,787 from the week before. This is another low since March 28, 2020, that is, just as the pandemic was emerging, and down sharply from the pandemic peak of 33.228 million reached in the week ended June 20, 2020. These figures are not seasonally adjusted.

Bespoke adds:

That was also 16K below expectations and the first better than expected print in six weeks. While recent releases have disappointed relative to forecasts, this week did mark the fourth week in a row that claims have dropped. That is the longest stretch of consecutive declines since a six-week streak ending on June 4th. (…)

Seasonally adjusted continuing claims missed expectations by 20K this week, but at 2.82 million, this week’s reading still marked a third consecutive decline. As such, claims are still at the lowest level of the pandemic and are closing in on coming within one million from the March 2020 levels. (…)

(Bespoke)

From Axios:

- Walmart CFO Brett Biggs and Target CEO Brian Cornell both made comments this week indicating consumer traffic in their stores has remained consistent over the last month. Both companies raised guidance for the full year.

- According to Bank of America’s debit and credit card spending data, which is a bit more comprehensive, spending growth cooled notably in the seven days ending Aug. 14. “A main reason behind the moderation over the last several weeks has been due to a pullback in spending on leisure services, which we define as travel (airlines + lodging), entertainment and restaurants/bars,” Bank of America head of U.S. economics Michelle Meyer wrote.

- Bank of America economists have maintained their official Q3 GDP growth forecast of +7.0%. But following the disappointing July retail sales report, they warned that GDP growth appeared to be tracking at closer to 4.5% growth for Q3.

- Not everyone is cutting due to the spread of the Delta variant. “We don’t expect the latest COVID wave to have a major growth impact,” TD chief U.S. macro strategist Jim O’Sullivan wrote this week. “We expect real GDP to slow from a still-very-strong 7% [rate for Q3].”

BTW, Goldman Sachs is at +5.5% for Q3’21.

Chase’s Card Spending Tracker does not look so weak through Aug. 15:

Although Travel and Entertainment has slowed down:

U.S. Leading Indicators Continue to Increase in July

The Conference Board’s Composite Index of Leading Economic Indicators increased 0.9% (10.6% y/y) during July following a 0.5% June rise, revised from 0.7%. The 1.2% May increase was unrevised. A 0.8% rise in the July index had been expected in the Action Economics Forecast Survey. The Leading Index is comprised of 10 components which tend to precede changes in overall economic activity.

The stronger increase in the leading index occurred as the leading credit index, the spread between short and long term interest rates and stock prices contributed more to the index rise. The length of the factory workweek, building permits, fewer initial jobless insurance claims and higher factory sector orders also added modestly to the rise. None of the ten component series contributed negatively to the index change.

The Index of Coincident Economic Indicators increased 0.6% in July (4.8% y/y) following an unrevised 0.4% June gain. The index rose 0.1% in May. Each of the four component series contributed positively to the July rise, as they did in June, including industrial production, nonfarm payrolls, personal income as well as manufacturing & trade sales.

The Index of Lagging Indicators rose 0.6% last month (-1.3% y/y) after no change in June. The average duration of unemployment and the change in the services CPI had the greatest positive effects on the index change in July.

INFLATION WATCH

(Data from ApartmentList.com)

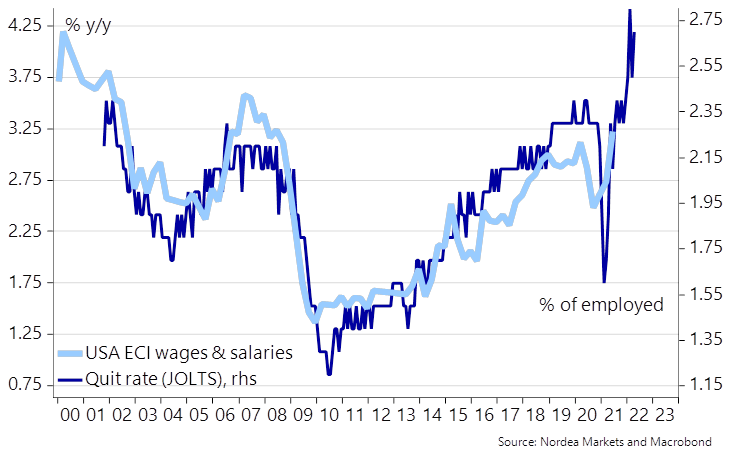

Wage growth is coming

Global equity funds see biggest weekly inflows in nearly 2 months-Lipper

Global equity funds lured their biggest weekly inflows in two months in the week ended Aug. 18, bolstered by strong corporate earnings and sustained hopes of an economic recovery.

According to Lipper data, global equity funds received $19.64 billion, the biggest inflow since late June.

U.S. equity funds attracted the majority of the money, securing inflows worth $13.3 billion, while Europe and Asian equity funds lagged, bagging just $4.5 billion and $0.5 billion respectively.

The majority of inflows going to North America was likely “a defensive measure towards burgeoning risk from the East”, said OCBC in a report. (…)

- Feeding the frenzy:

Source: GMO (Via Barry Ritholtz)

Source: GMO (Via Barry Ritholtz)