![]() Note: I am travelling in Asia until April 24. Limited equipment and different time zones will limit the frequency and depth of my postings.

Note: I am travelling in Asia until April 24. Limited equipment and different time zones will limit the frequency and depth of my postings.

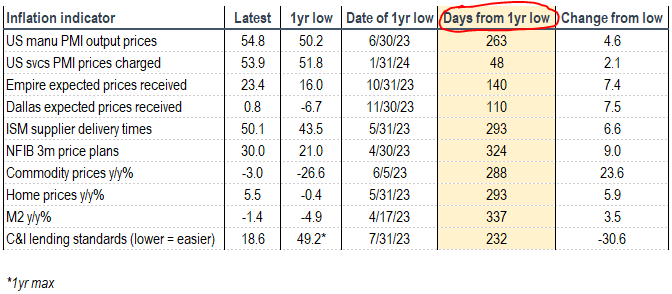

Underlying inflation measures remain sticky, which could delay rate cuts.

Source: MRB Partners

Source: MRB Partners

Consensus says the #Fed should cut rates. BUT, a host of inflation and liquidity barometers started signaling more not less #inflation around mid-2023. (Source: Richard Bernstein Advisors)

Canada Inflation Unexpectedly Cools to 2.8% in February Consumer prices rose 2.8% in February from a year earlier, Statistics Canada reported, where economists expected the rate to advance to 3.1%.

It marks a second month running where the consumer-price index has been inside the Bank of Canada’s 1% to 3% target, after it cooled to 2.9% in January.

On a month-over-month basis, inflation climbed 0.3% after no change in the first month of the year. (…)

Excluding food and energy costs, the consumer-price index advanced 2.8% in February from a year earlier.

Two measures of annual core inflation the central bank closely monitors also continued to cool. Weighted median and trimmed mean CPI rose an average 3.15%, the softest level since August 2021 and compared with 3.35% growth in January. (…)

It marks a second month running where the consumer-price index has been inside the Bank of Canada’s 1% to 3% target, after it cooled to 2.9% in January.

On a month-over-month basis, inflation climbed 0.3% after no change in the first month of the year. (…)

Excluding food and energy costs, the consumer-price index advanced 2.8% in February from a year earlier.

Two measures of annual core inflation the central bank closely monitors also continued to cool. Weighted median and trimmed mean CPI rose an average 3.15%, the softest level since August 2021 and compared with 3.35% growth in January. (…)

From Goldman Sachs:

(…) Excluding food and energy, CPI inflation declined by 0.3pp to +2.8% yoy, the lowest rate since July 2021. BoC-preferred CPI-Trim and CPI-Median were softer than consensus expectations at +3.2% (vs. +3.4% in January) and +3.1% (vs. +3.3%) on a yoy basis, respectively.

On a three-month average annualized basis, CPI-Trim declined to +2.3% in February from +3.2% in January and CPI-Median edged down to +2.1% from +3.1%. The average of the preferred three-month measures is now at the lowest level since January 2021. On a month-over-month annualized basis, CPI-Trim (+1.2%) and CPI-Median (+1.1%) remained essentially unchanged at low levels in February.

On a seasonally adjusted monthly basis, headline CPI inflation was +0.1% in February, up from -0.1% in January. (…) Seasonally adjusted CPI ex food and energy inflation was unchanged at +0.1% in February.

Sequential core goods inflation remained soft at -0.4% in February (mom GS sa, vs. -0.6% in January) and moderated further for durable goods (-0.3pp to -0.8%). (…)

Monthly inflation for rented accommodation ticked up by one tenth to +0.8%, while sequential inflation for the mortgage interest cost component decelerated further to +1.3%, down from +1.6% last month and a peak of +2.7% in 2023, in line with our expectations. Sequential inflation for most non-shelter wage-sensitive categories—such as food purchased from restaurants, household services, and health care services—was roughly unchanged at moderate levels.

Euro-Area Labor-Cost Growth Slowed at End of 2023

China’s Fiscal Stimulus Plan May Be Bigger Than It Appeared

China kept its official budget deficit target unchanged at 3% of gross domestic product, but that underplays government support because it leaves out a large amount of investment spending.

Using the simplest definition of stimulus — the demand injected into the economy by government spending minus the purchasing power removed via taxes and fees levied — the fiscal package in proportion to the size of the economy is the strongest since 2020, when China moved to shore up growth in the face of the pandemic. (…)

The trouble is that it leaves out China’s other fiscal accounts. The largest of those is the “government-managed funds account,” which covers investment in construction projects, as well as income derived mainly from land sales. This account usually has a large deficit, made up by bond issuance. Combining that with the general budget, the shortfall amounts to 11.1 trillion yuan, or almost triple the size of the official fiscal deficit.

National authorities can also unleash leftover funds from prior years, as well as cash transfers from other fiscal accounts, such as profits submitted by state-owned enterprises. Officials have said that most of the roughly 1 trillion yuan raised from October’s additional sovereign bond issuance will be used in 2024.

“The fiscal numbers are pretty decent, a pretty solid additional impulse from last year” overall, said Andrew Polk, a co-founder of the research consultancy Trivium.

Zooming out, the planned 11.1 trillion yuan figure for the augmented fiscal deficit — an estimate of all the main fiscal resources — is equivalent to 8.2% of GDP this year, according to Bloomberg calculations based on Ministry of Finance data. That would represent the highest deficit-to-GDP ratio since 2020.

And the tally could end up representing even more than 8.2%, thanks to deflation. That’s because that figure is measured against nominal GDP, which includes the growth of prices. If price growth is weak or negative, that 11.1 trillion yuan deficit will represent a bigger slice of the pie. (…)

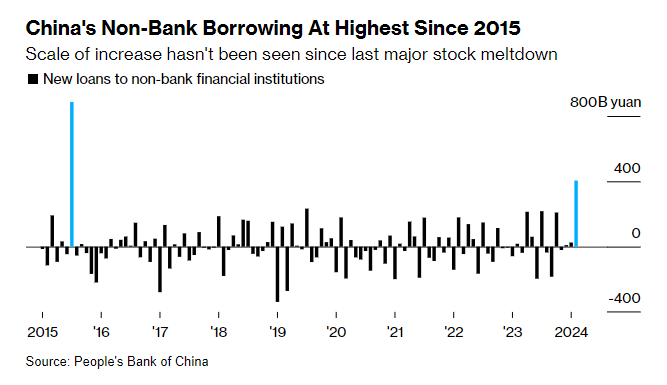

China’s $55 Billion Loan Surge Points to ‘National Team’ Rescue

China’s loans to non-bank financial institutions surged in February by the most in seven years, prompting speculation that lenders provided a big boost of capital to state funds as they bought shares to help stem a multi-trillion dollar market rout.

Loans to non-bank financial institutions, including brokerages and mutual funds, grew by more than 400 billion yuan ($55.6 billion) last month, according to the latest data from the People’s Bank of China. That was the biggest jump since July 2015, around the last time the so-called national team of state-related bodies bought up equities to stabilize turbulent markets.

“China’s non-bank financial institutions usually don’t have so much borrowing need,” said Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group Ltd. He attributed the increase to the national team likely borrowing from a commercial bank.

China took various efforts earlier this year to stem a $7 trillion slide in mainland and Hong Kong stock markets, which became the most acute symbol of depressed confidence in the world’s second-largest economy. There is evidence that state institutions, including sovereign wealth fund Central Huijin Investment Ltd., snapped up shares to bolster market confidence.

Several exchange-traded funds in China saw a surge in turnover after the Lunar New Year holiday last month, a likely sign of that support. In recent weeks, Chinese stocks have rallied, with a number of benchmarks surging 20% from earlier lows.

Private estimates of “national team” buying are broadly in line with the PBOC data on non-bank borrowing. State funds poured more than 410 billion yuan into onshore shares this year, according to estimates by UBS Group AG late last month. Purchases in January and February reached nearly 300 billion yuan, Bloomberg Intelligence projections<?XML:NAMESPACE PREFIX = “[default] http://www.w3.org/2000/svg” NS = “http://www.w3.org/2000/svg” /> show. (…)

SENTIMENT WATCH

Nvidia was up a measly 1% today despite the exciting presentation, after Monday’s close, by CEO Jensen Huang about the company’s future in the AI ecosystem. He announced a new generation of GPU chips and software for running AI models. The first chips in the new Blackwell platform will be shipped later this year. They are more powerful (with a five-fold increase in petaflops) and consume less energy than the current ones. On CNBC today, Huang estimated that one chip will cost $30,000 to $40,000.

Today’s lackluster gain in Nvidia’s stock price suggests that the stock and the overall stock market have discounted a lot of good news. (…)

Meanwhile, we don’t like what we are seeing in the crude oil pits. The price of a barrel of Brent crude oil is up 19.3% since December 12, 2023 to $87.38 today. It might be on the verge of a breakout to $90.00. There is a channel formation in the chart suggesting that the price could rise to $100.00 during the second half of this year. Such a scenario would be all too reminiscent of the 1970s, posing a threat to our Roaring 2020s outlook. We’ll be monitoring Ukrainian attacks on Russia’s oil infrastructure and the ongoing turmoil in the Middle East. (…)

Or, on a happier note, maybe rising oil prices suggest that the global economy is picking up.

- Here is Goldman’s sentiment indicator.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

- Equity fund inflows have been exceptionally strong.

Source: BofA Global Research

Source: BofA Global Research