U.S. FLASH PMI: Further loss of service sector momentum weighs on overall US economic performance

US businesses signalled a broad stagnation in output at the end of the third quarter as manufacturers and service providers alike indicated muted demand conditions. September data indicated the worst performance across the private sector since February, as the service economy lost further momentum.

New orders fell at the strongest pace this year so far as demand for services slipped further into contractionary territory. Manufacturers also saw a drop in new sales, albeit at a slightly softer pace.

Cost pressures ticked higher again, as input prices rose at a marked pace. Nonetheless, the rate of cost inflation was much softer than those seen on average throughout the last three years. Firms continued to pass through higher costs to clients, but weak client interest stymied their ability to hike selling prices as the pace of increase matched that seen in August.

The headline S&P Global Flash US PMI Composite Output Index posted 50.1 in September, down fractionally from 50.2 in August, to signal a broad stagnation in activity across the private sector. The headline index reading fell for the fourth successive month and indicated the weakest overall performance since February.

(…) Driving the slowdown was the service sector, where firms recorded the slowest rise in business activity in the current eight-month sequence of growth. Companies often noted that high interest rates and inflationary pressure led to weak client demand which weighed on overall output. Some also mentioned cancellations of customer orders as market conditions worsened.

Subsequently, the subdued demand environment sparked a faster decline in new business in September. The rate of contraction was the sharpest since December 2022, with service providers leading the downturn. Service sector firms saw a solid decrease in new business, following pressure on customer purchasing power from high inflation and interest rate hikes. (…)

At the same time, a renewed fall in service sector new export orders led to another marginal decrease in total foreign client demand. Higher prices charged for exported goods and recession concerns in key export markets in Europe reportedly dragged on external demand.

Business confidence across the US private sector dipped to a nine-month low at the end of the third quarter. Despite still expecting output to increase over the coming 12 months, the degree of optimism was weaker than the series average as strikes, inflation, higher borrowing costs and muted demand conditions dampened expectations.

Manufacturers expressed greater positive sentiment amid improving supply chains and increased investment in marketing. However, service providers were at their least optimistic in 2023 so far as strain on disposable incomes worsened.

Despite a muted sales environment, US businesses registered greater hiring activity during September. The rate of job creation quickened to the fastest since May and was solid overall. In fact, the pace of employment growth was among the most elevated seen in the past year amid some reports that staff retention was improving. Companies also noted that vacancies were filled with greater ease than had been seen in recent months.

The pace of increase in staffing numbers accelerated at both manufacturing and services firms, with the latter signalling a notable uptick in hiring. (…)

Pressure on capacity continued to wane as backlogs of work were depleted at a steep pace. The rate of decline gained further momentum, with outstanding business falling at the sharpest rate since May 2020. Efforts to sustain output through work on incomplete orders led to a substantial decrease in backlogs, as firms noted that lower new order inflows led to increased spare capacity.

Hikes in wage bills, borrowing costs and material prices, with many panellists mentioning greater fuel expenses, drove up cost inflation in September. The overall rate of input price inflation quickened to the sharpest since June. The faster uptick was led by manufacturing firms where the pace of increase accelerated to the steepest since April as higher oil prices pushed up chemicals, plastics and transportation costs.

Meanwhile, firms found it challenging to pass through the full extent of higher cost burdens to clients amid soft demand conditions and reduced purchasing power among customers. The rate of charge inflation was historically elevated but matched that seen in August and was among the slowest in three years. Manufacturers saw only a marginal rise in output prices as they sought to pass on any cost savings to clients in a bid to remain competitive.

Just 2 days after Mr. Powell told us that “what’s happened is growth has come in stronger, right—stronger than expected and that’s required higher rates”, the PMI is signalling:

- a broad stagnation in output for the second consecutive months

- muted demand conditions

- contracting new orders, manufacturing and services (“solid decrease”), domestic and foreign

- cancellations of previous orders

At the same time, it sees:

- greater hiring activity, fastest since May and solid overall

- amid steeply depleting backlogs of work and increasing spare capacity

- input price inflation quickening to the sharpest since June

- output price inflation the slowest in three years

That sounds like stagflation and compressing profit margins, doesn’t it? If so, C-suites might reassess their employment strategies. From S&P Global (my emphasis):

Backlogs of work – a key proxy for capacity utilization – fell in September at a rate which, barring early pandemic lockdown months, was the steepest since comparable data across manufacturing and services were first available in late 2009. Backlogs fell in both sectors, with the service sector seeing a notable acceleration in the rate of decline.

The drop in the PMI-Services from 55 in the spring to 50 coupled with the “solid decrease” in new orders raises the possibility of a soft patch coming.

With all the new headwinds (auto strike, gov. shutdown, student loans, oil prices), things can change rapidly…

This next chart shows MoM growth in real spending on goods and services and in real wages (black) since February. Notice the sharp acceleration in spending in June and July as real wages also accelerated.

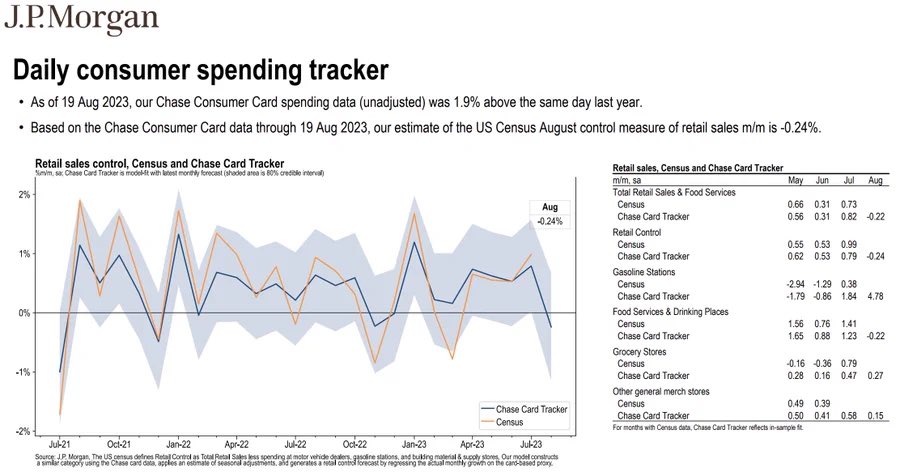

Then came the spike in oil prices, from $66/bbl in early July to $85 in early August and to $90 last week. We get August spending data on Friday but we know that Control Retail Sales (ex-auto/gas/restaurants), grew only 0.1% in August after +0.55% on average in the previous 4 months.

The flash PMI combined with negative real wage growth hint at much weaker demand in both goods and services.

As shown here on September 7:

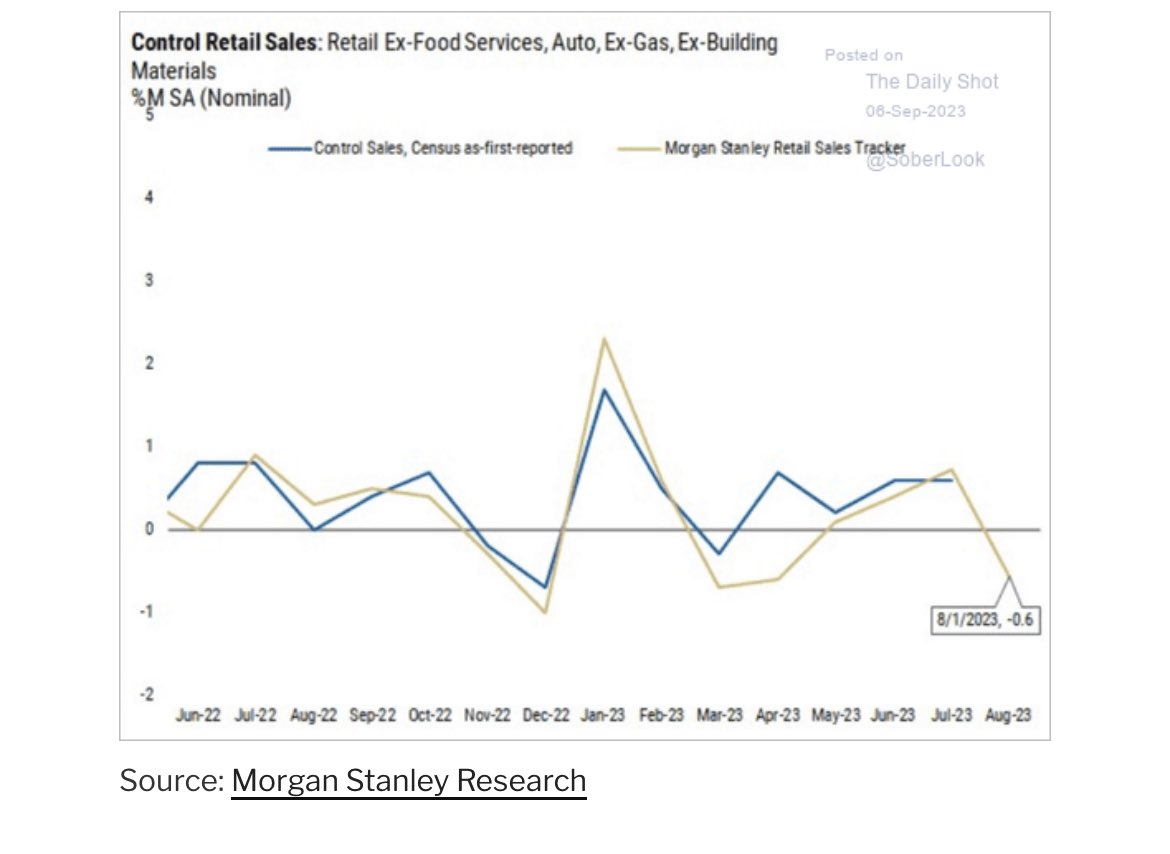

After the spectacular summer retail sales data, Morgan Stanley and J.P. Morgan warn of a very weak August (h/t @BobEUnlimited):

Volatile times, volatile narratives.

On a seasonally adjusted annual rate basis, the Wards forecast of 15.4 million SAAR, would be up 2% from last month, and up 13% from a year ago.

But notice the weakening demand since April.

Fed Officials See More Rate Hikes Possible While Inflation Persists Governor Bowman signals more than one increase ‘likely’ needed

Two Federal Reserve officials said at least one more interest-rate hike is possible and that borrowing costs may need to stay higher for longer for the US central bank to ease inflation back to its 2% target.

While Boston Fed President Susan Collins said further tightening “is certainly not off the table,” Governor Michelle Bowman signaled that more than one increase will probably be required, cementing her position as one of the Federal Open Market Committee’s most hawkish members. (…)

“I see a continued risk that energy prices could rise further and reverse some of the progress we have seen on inflation in recent months,” she said. (…)

Bowman also noted that monetary policy appears to be having less bite on lending than might be expected.

“Despite this tightening of bank lending standards, we have not seen signs of a sharp contraction in credit that would significantly slow economic activity,” she said.

Separately on Friday, San Francisco Fed President Mary Daly said she is not ready to declare victory in the fight against inflation, and that the central bank is still committed to curbing price pressures “as gently as possible.” (…)

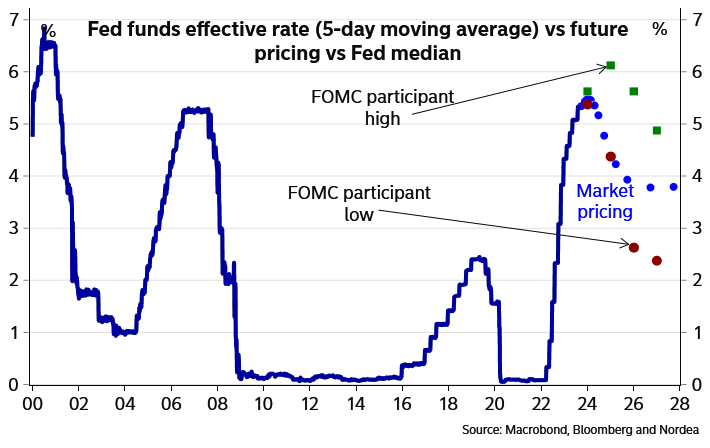

Nordea: “So far, both the ECB and the Fed have managed to hammer through the message that rates will remain higher for longer.”

Although obviously not a unanimous view among FOMC participants:

Deviations in the individual forecasts considerable for the coming years

Rebound in Immigration Comes to Economy’s Aid A rise in the foreign-born labor force is boosting worker supply, easing wage pressure and aiding the Federal Reserve’s goal of a “soft landing.”

(…) This year, average monthly growth in the foreign-born labor force is about 65,000 higher compared with 2022 on a seasonally adjusted basis, a Goldman Sachs analysis found. After plunging at the start of the pandemic, the size of the foreign-born labor force has rebounded, nearing 32 million people in August.

Foreign-born workers’ share of the labor force—those working or looking for work—reached 18% in 2022, the highest level on record going back to 1996, according to the Labor Department. It has climbed further this year to an average of 18.5% through August, not adjusted for seasonal variation.

The jump in the share of foreign-born workers in the labor force reflects an easing in immigration backlogs that accumulated during the Trump administration and at the onset of the Covid-19 pandemic.

U.S. consulates around the world shut down when the pandemic broke out and, because of staff attrition and local country restrictions, took longer than most offices in the U.S. to reopen. As a result, visa issuance plummeted. (…)

By 2022, though, the U.S. granted more than a million work visas, hitting a 25-year high, according to an analysis of government figures by USAFacts, a nonpartisan data provider. It issued nearly 500,000 green cards to immigrants moving to the U.S. permanently, the highest total since 2018, government data show.

In addition, the administration has made unprecedented use of a little-known immigration power known as humanitarian parole to quickly and legally let in hundreds of thousands of people from places such as Ukraine, Afghanistan and Venezuela. (…)

Since early 2020, the foreign-born participation rate, now roughly 67%, has grown above its prepandemic average by 1.5 percentage points, while that for native-born Americans remains 0.5 points below, Goldman found. (…)

Giovanni Peri, an economist and director of the Global Migration Center at the University of California Davis, said that while increased immigration is helping ease labor-market tightness, that is “because there was a backlog.” He said more lasting relief to worker shortages in some industries requires a more deliberate policy change, “which, as of now, doesn’t seem to be there.” (…)

National Bank CEO Warns of Harsh ‘New Reality’ for Borrowers Fixed-rate loans make up about two-thirds of its mortgage book

Many of the firm’s clients with fixed-rate mortgages — accounting for about two-thirds of its home-loan book — will soon face a harsh “new reality,” Ferreira said Thursday in an interview.

About 85% will need to renew those loans — which haven’t yet been affected by higher interest rates — in 2024 through 2026, said Ferreira, who became CEO two years ago.

Canada’s sixth-biggest bank is trying to prepare them for the shock, he said, noting that clients with variable-rate loans that increase along with interest rates have already seen average monthly payments increase by C$600 a month in Quebec and C$1,200 in Ontario.

And they shouldn’t count on rates dropping anytime soon, Ferreira said.

During a speech earlier in the day in the bank’s hometown of Montreal he predicted inflation will remain sticky and that interest rates will stay high over the next year. (…)

Receipts for retailers dropped 0.3% in August, the first decline since March, according to an advance estimate from Statistics Canada released Friday. That followed a 0.3% increase a month earlier, which missed the median estimate of 0.4% in a Bloomberg survey. (…)

Motor vehicle and parts dealers saw the largest decrease that month, and fell for the first time in four months. Excluding autos, retail sales rose 1%, double the expectations.

In volume terms, retail sales edged down 0.2% in July. (…)

“Given that population growth has accelerated in recent months, retail sales volumes are doing even worse in per capita terms as higher interest rates take a heavy toll,” Stephen Brown, an economist at Capital Economics, said in a report to investors. “Those new arrivals should be boosting aggregate spending, leaving little doubt that higher interest rates continue to weigh heavily on consumers’ spending power.” Canada has been adding about 300,000 people per quarter. (…)

The headline figure was curbed by motor vehicles/parts and by gasoline stations receipts. Core retail sales, which exclude the two former sectors, posted their first positive print since April (+1.3%).

Workers get a 10-per-cent raise in the first year of the deal, then 2 per cent and 3 per cent in the following years, according to information provided by Unifor.

Workers in the skilled trades will receive raises of an additional 2.75 per cent in Year 1 of the contract and 2.5 per cent in Year 3. (…)

The agreement boosts a production worker’s hourly wage to $42 in the first year of the deal to $44.50 by the third year, from $37 now. A skilled tradesperson will make $56 an hour by the end of the contract, up from almost $45 now. These rates include cost of living top-ups.

New hires currently start at $24 an hour and take eight years to make the standard hourly rate of $37. Under the new contract, these employees join the regular pay scale after four years. (…)

The agreement includes a renewed commitment from Ford not to close any facilities during the life of the contract, and additional capacity and upgrades at the Windsor plant that makes the 7.3-litre engine.

Also: pension improvements and a $10,000 signing bonus.

Simple math:

- production workers: $37 to $44.50 = +6.8%/yr on average

- skilled workers: $45 to $56 = +8.1%/yr on average

- all workers get $10k signing bonus, about +12% = +4%/yr on average. In total: +11-12% per year over 3 years.

Oil at $100 Is Too High, Even for Energy Companies As crude oil prices near triple digits, it isn’t just consumers feeling uneasy

(…) One reason for caution is high prices’ impact on demand. Generally speaking, oil prices above $100 a barrel tend to be motorists’ pain point, spurring some to drive less. In June and July 2022, when Brent crude prices averaged roughly $110 a barrel, gasoline demand in the U.S.—the biggest consumer of oil—fell 4.1% compared with the same period a year earlier when prices had a $70 handle. The year-over-year gap in gasoline demand narrowed in the following months as oil prices fell.

And Americans might soon have new reasons to feel frugal. In August, American households making $50,000 to $100,000 a year had about 50% more in their savings and checking accounts than prepandemic levels, down from an excess of nearly 100%, according to the Bank of America Institute. Their wallets are at risk of even more erosion when student-loan repayments are set to resume next month—to the tune of $100 billion a month by some estimates.

The risk of a pullback in fuel consumption is especially high in developing countries. While oil prices and the value of the U.S. dollar often move in opposite directions, they have been rising in tandem recently, notes Ilia Bouchouev, managing partner at Pentathlon Investments. That places extra pressure on countries such as China and India that must buy dollar-denominated oil. (…)

In dollar terms, Brent crude prices have moved up about 7.4% year to date. In Chinese yuan terms, they are up 13%. While the price cap on Russian oil helps cushion that impact, China and India source oil from other countries, too.

Moreover, crossing a psychologically significant price is likely to elicit government responses that are unfavorable to energy companies. Record oil company earnings last year prompted the European Union to impose a windfall profits tax on fossil fuel companies. President Biden has threatened to do the same in the U.S. And the longer high prices persist, the bigger the government response is likely to be. The U.S. passed its fuel economy standards in 1975 after the oil-price shocks of the early 1970s, for example. (…)

Saudi Arabia, which holds some 3.3 million barrels a day of spare capacity, according to the International Energy Agency, has a strong incentive to bring more oil to market if it sees signs of the commodity’s price crimping the global economy. (…)

China Developers Drop Most in 9 Months on Evergrande Woes

(…) Evergrande, which scrapped key creditor meetings at the last minute and said it must revisit its restructuring plan, dived 22%. China Aoyuan Group Ltd. was the biggest drag on the index, slumping by a record 72% after shares resumed trading following an 18-month halt. (…)

Last week, China’s securities regulator said it launched an inquiry into Ping An Real Estate Co. over an undisclosed overdue loan payment. China Oceanwide Holdings Ltd. on Monday disclosed it is facing liquidation after a Bermuda court issued a winding-up order. Worries are also growing that Country Garden Holdings Co. may suffer an imminent default. (…)

The September to October time-frame tends to be one of the busiest seasons for homebuying, and news of Evergrande’s challenges risk weighing on already tepid demand. (…)

The malaise also threatens to dampen sentiment among developers with relatively healthier balance sheets. Just last week, Moody’s Investors Service put two of China’s few investment-grade developers on review for possible downgrade. The ratings firm noted high uncertainty over their credit metrics recovery and future prospects. (…)

Evergrande faces an Oct. 30 hearing at a Hong Kong court on a winding-up petition, which could potentially force it into liquidation.

The distressed real estate giant said late Sunday it couldn’t satisfy requirements of the China Securities Regulatory Commission and the National Development and Reform Commission to issue new notes. It cited an investigation of subsidiary Hengda Real Estate Group Co., without elaborating. The unit said in August that CSRC had built a case against it relating to suspected information disclosure violations. (…)

Several Chinese developers are contending with similar winding-up lawsuits from foreign stakeholders frustrated by what they see as the slow pace of restructuring talks. Such petitions can potentially force a court-ordered liquidation. (…)

U.S. Energy Department announces $325-million for batteries that can store clean electricity longer

The U.S. Energy Department has announced a US$325-million investment in new battery types that can help turn solar and wind energy into 24-hour power.

The funds will be distributed among 15 projects in 17 states and the Red Lake Nation, a Native American tribe based in Minnesota.

Batteries are increasingly being used to store surplus renewable energy so that it can be used later, during times when there is no sunlight or wind. The department says the projects will protect more communities from blackouts and make energy more reliable and affordable. (…)

The new funding is for “long-term” storage, meaning options that can last for longer than the four hours typical of lithium ion batteries. (…)

The projects feature a range of batteries that provide up to 100 hours of power. (…)

SEASONALITY

- All is as it (seasonally) Should be? But then again, closing our eyes to all of the macro and technicals and everything else, maybe this is just the expected seasonal dip. And in that respect, dip-buyers should be waiting until the seasonal turbulence passes (and when we all start talking about Q4/year-end/Santa Claus rallies!). (Callum Thomas)

Source: Topdown Charts

As this 3fourteen Research chart illustrates, this has been the worst “equal-weight” snap back from the low.

Rising interest rates don’t blend well with high valuations.

The S&P 500 sells at 20.0x trailing EPS of $216.54 which are 3.1% lower than last year. On forward EPS of $232.63 (up 2.2% from last year): 18.6x.

Excluding the 6 mega-cap high-P/Es, the other stocks sell at 18.3x trailing and 16.9 forward. The latter is closer to what would be reasonable but you have to trust analysts’ estimates. Not a terribly tall order given the 7.4% estimated growth rate but profit margins have been declining all year and they may have further to fall.

- One, recent PMIs suggest widespread margins pressures and discounting.

- Two, the USD has been very strong which is hurting multinationals’ profits.

- Three, rising interest expense are not done eating into operating profits:

Source: Daily Chartbook

Big Shareholder in China? Don’t Try Selling Chinese regulators have taken a novel approach to prop up the country’s faltering stock market by banning many companies’ biggest shareholders from selling.

(…) The CSI 300 index of the country’s largest listed companies is down 4.1% in the year-to-date period, following losses in the previous two calendar years.

Authorities in China have taken several steps to boost the market recently, including cutting a tax on stock trading and slowing the pace of new listings to help balance supply and demand.

The country’s securities regulator has also curbed share sales from controlling shareholders of listed companies that haven’t paid dividends in the past three years, or whose shares are trading below their IPO prices or net asset values.

The new rules effectively placed share-sale restrictions on about half of the 5,000-plus companies that trade in Shanghai or Shenzhen, according to Wind, a provider of financial data. (…)

Shareholders of more than 200 companies sprang into action by canceling plans to trim stakes, making public promises not to reduce their holdings further and extending lockup periods for their shares. Dozens of other companies proposed buybacks that could help support their share prices. (…)

Corporate insiders in China have been net sellers of shares of their own companies for years. In 2020, officers and directors at more than 1,200 companies net sold the equivalent of $17 billion worth of stock, the highest total on record, according to Wind. So far this year, company insiders have sold a net $4.4 billion worth of shares. (…)

While the tightened supervision could help stabilize the market in the short run, Gatley said it could also discourage institutional investors from putting more money into China’s stock market because of uncertainty over whether they can sell out in the future.

“It undermines the perception of the Chinese stock market as a liquid place to allocate capital,” he added.