US Demand Is Still Resilient, Even If GDP Doesn’t Show It Final sales to private domestic purchasers rose a robust 3.1%

Gross domestic product advanced at a 1.6% annualized rate, below all economists’ projections, with the biggest restraints stemming from less inventory accumulation and a wider trade gap.

However, so-called final sales to private domestic purchasers, which strips out inventories, trade and government spending, rose at a 3.1% rate after adjusting for inflation. For three straight quarters, this key gauge of underlying demand has expanded at least 3%.

That helps explain why the Federal Reserve’s progress on tamping down inflation late last year has stalled.

A closely watched measure of underlying price pressures advanced at a greater-than-expected 3.7% clip last quarter, the first acceleration in a year, the Bureau of Economic Analysis report showed Thursday. (…)

The first-quarter pickup in inflation was driven by a 5.1% jump in service-sector inflation that excludes housing and energy, nearly double the prior quarter’s pace. March figures on inflation, consumer spending and income are due Friday. (…)

While softer than forecast, personal spending increased at a still-healthy 2.5% pace. That was driven by the biggest gain in services outlays since 2021, fueled by health care and financial services. Business outlays for equipment picked up for the first time in nearly a year.

Moreover, residential investment registered the strongest advance in more than three years.

Spending on goods, however, decreased for the first time in more than a year, restrained by motor vehicles and gasoline. (…)

Separate data out Thursday showed initial applications for unemployment benefits fell to 207,000 last week, the lowest level in two months. Continuing claims also decreased. (…)

After an unsettling headline miss, the picture that emerges from the details in today’s GDP report is actually more of the same in terms of the factors that are standing in the way of a lower rate environment.

Consumers are still spending, they are just prioritizing activities in the service sector. Spending on non-durable goods stalled in the quarter while outlays on big-ticket durable goods items contracted at a 1.2% annualized rate. That was not nearly enough to offset the much larger services category, where consumers spared no expense in the first quarter.

Like a relief pitcher in the late innings, services spending came in throwing heat in the first quarter with a blistering 4.0% annualized growth rate—the fastest surge in consumer services spending since the stimulus-fueled binge in 2021. Excluding 2020 & 2021, services has only come in above 4.0% three times in the last two decades (once in 2014 and twice in 2004). Higher rates are intended to cool consumer demand; the trouble for the Fed is: it’s not working.

The core PCE deflator rose at a 3.7% annualized rate in Q1, a notable acceleration after a sharp slowing the prior two quarters. This data implies a strong 0.4% increase in March core PCE, set to be released tomorrow. Services excluding energy and housing rose at a 5.1% annualized rate in Q1, the fastest in a year. (…)

In looking through some of these volatile factors, underlying growth remained quite solid in the first quarter. Real final sales to domestic private purchasers, which strips away net exports, inventories and government investment and gets at the underlying trend in domestic demand, rose at a 3.1% annualized rate during the quarter. The last three quarterly prints for this measure have all come in at 3.0% or higher, signaling healthy and stable growth. Don’t underestimate this economy.

- Traders pushed back the timing of the first rate cut to December from November. Treasuries sold off, and equities slid.

CONSUMER WATCH

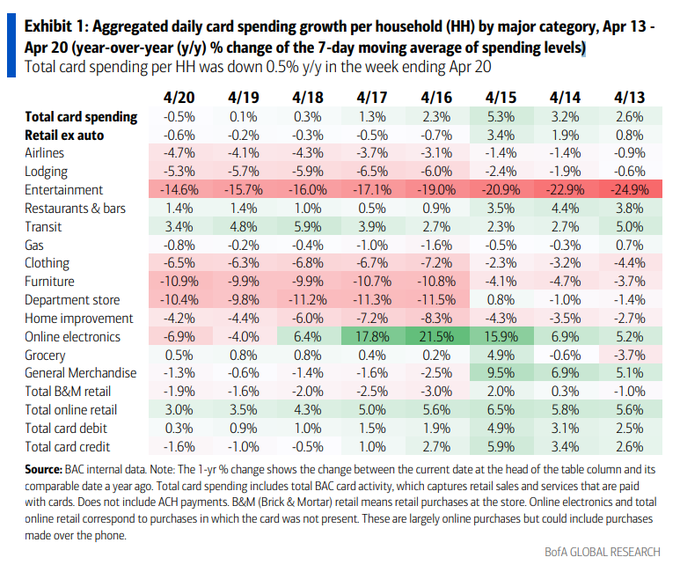

- BofA: Total card spending per HH was down 0.5% y/y in the week ending Apr 20, according to BAC aggregated credit & debit card data.

- Retail ex auto spending per HH came in at -0.6% y/y in the week ending Apr 20.

- The slowdown in total card spending over the last few days of the sample was likely due to services. (MikeZaccardi)

Labor Tightness Lingers

We received further confirmation today that labor conditions remain tight, with both initial and continuing unemployment claims declining on a week over week basis and coming in beneath estimates. Initial claims dropped to 207,000 during the week ended April 20 versus the projected 214,000 and the previous period’s 212,000. Continuing claims for the week ended April 13 fell to 1.781 million from 1.796 million the week before while economists were expecting a number closer to 1.814 million. Both figures are indeed trending lower, with the four-week moving averages moving down to 213,250 and 1.794 million from 214,500 and 1.801 million during the prior weeks.

China to Pay Consumers Up to Nearly $1,400 to Replace Old Cars China plans to give car owners up to nearly $1,400 to replace their old cars with new ones, a move to boost slowing demand in the world’s largest electric-vehicle market.

Consumers who replace their cars with electric or hybrid vehicles can in some cases receive government subsidies of up to 10,000 yuan ($1,381) through the end of this year, China’s Ministry of Commerce and other departments said in a joint statement Friday. People trading in older cars for traditional cars with engines sizes of 2.0 liters and below are eligible for CNY7,000.

China’s policymakers are trying to boost consumption amid subdued domestic demand in the world’s second largest economy. Estimated passenger car retail sales dropped 1.5% on year in April, swinging from a growth of 6.2% last month, China Passenger Car Association data showed Thursday.

Beijing launched a similar trade-in program to boost domestic consumption in 2009 and 2010.

States Take On China in the Name of National Security Local politicians impatient with Washington’s actions against Beijing block Chinese land purchases, factory plans and research

States have a new adversary: China.

From Florida to Indiana and Montana, an expanding array of local proposals, bills, laws and regulations aim to block Chinese individuals and companies from acquiring land, winning contracts, working on research, setting up factories and otherwise participating in the U.S. economy.

State officials, overriding traditional local interests such as drawing investment and creating jobs, say they are acting where Congress hasn’t to address grassroots American distrust of the Chinese Communist Party.

The states have generally been moving faster on China legislation than Congress. By the time a bill that could force a sale of TikTok by its Chinese owner ByteDance reached President Biden’s desk Wednesday, over 30 state governments had passed regulations targeting the short-video app.

In their efforts to challenge perceived China threats, states are often claiming authority to define national-security risks.

“There is a real responsibility on behalf of governors and state legislatures to look out for the safety and protection of our citizens,” said Virginia Gov. Glenn Youngkin, who last year blocked Ford Motor from setting up a battery venture in his state with China-based Contemporary Amperex Technology, or CATL. He has also signed bills to curb Chinese land purchases and use of TikTok on state devices.

Youngkin says he opposed the plant for electric-vehicle batteries because he didn’t want to allocate Virginia taxpayer money to support Chinese technology. Ford is now building a scaled-down version of the project in Michigan, where it has also faced localized resistance.

When Iowa’s state Senate passed a bill this month to shield some of the world’s biggest chemical makers from certain pesticide lawsuits, its legislation specified that one type of company would be ineligible for the protection: Chinese. (…)

Since early 2023, states and the District of Columbia have introduced 624 pieces of legislation related to China, rivaling Congress’s 663, according to information service BillTrack50.com. (…)

Grand Forks, N.D., last year stopped a Chinese food ingredient maker, Fufeng Group, from building a corn-processing plant that promised to create 1,000 jobs. State and local authorities had initially welcomed Fufeng’s expected $700 million investment, pitched as the city’s largest private investment ever, but support collapsed when claims were made—with little substantiation—that the facility could be a conduit to spy on nearby Grand Forks Air Force Base. (…)

Fufeng later identified a site for its plant in Indiana, only to get tripped up by a new state law that forbids Chinese and other designated adversaries from entering deals for agricultural land.

One of the bill’s proponents, Indiana State Sen. Jean Leising, acknowledged the proposed plant was popular among corn farmers and that she was warned that between Fufeng and 10 other Chinese investors, the legislation would cost Indiana $14 billion in lost income. She reasoned that sacrifices are necessary. “Safety or revenue, you sometimes have to make a decision,” she said. (…)

Syngenta is also under fire in Arkansas, where authorities fined the company $280,000 and ordered it to sell 160 acres it has owned for 36 years for violating a new law barring land holdings by a “prohibited foreign-party-controlled business.” A spokeswoman for Gov. Sarah Huckabee Sanders said, “Gov. Sanders has promised Arkansans she’ll step up where the federal government has failed.” (…)

In a sign of inconsistencies between states pursuing similar goals, the same Indiana land-use bill that stopped Fufeng from building a plant there grandfathered Syngenta, which has around 100 employees and 115 acres in the state. (…)

Florida has legislated some of the most far-reaching China decoupling. While campaigning for president last year, Gov. Ron DeSantis signed a law to stop land purchases, block state contracting and university partnerships involving Chinese nationals. His office termed the package “a blueprint for other states.” (…)

Several efforts have faced legal challenges.

After Montana imposed an outright ban on TikTok in the state, a judge blocked the measure, citing the First Amendment—an avenue the company is expected to explore in challenging the federal legislation. Asian-Americans in Texas took credit last year for killing a state legislative effort to ban Chinese land ownership.

And in Florida, three Chinese nationals from large public universities argued in a suit against state agencies such as the state Education Department that new hurdles to their participation in academic research are unconstitutionally race-based. (…)

Trade restrictions in various forms are now ubiquitous worldwide:

Xi Warns Blinken Against ‘Vicious Competition’ Between US, China China’s Wang Yi sees rising ‘negative factors’ in relationship

(…) Overall the talks were cordial and muted, bolstering expectations that the two countries can keep ties steady.

“China and the United States should be partners rather than rivals,” Xi told Blinken, according to a Chinese Foreign Ministry statement. The two sides should “seek common ground and reserve differences, rather than engage in vicious competition,” he added. (…)

China’s Foreign Minister Wang Yi accused the US of taking “endless measures to suppress China’s economy,” during five-and-a-half hours of talks with Blinken, which included a working lunch. “This is not fair competition, but containment — and it is not removing risks, but creating risks,” he added, citing curbs on technology.

Blinken stressed to his Chinese counterpart US concerns over Beijing’s support for the Kremlin’s military industrial base, peace around Taiwan — which the Communist Party considers its territory — and China’s military activity in the South China Sea. He also brought up China’s “non-market practices.” (…)

Huawei’s New Phone Runs Latest Version of Made-in-China Chip The Pura 70 relies on a 7nm chip similar to the Mate 60’s

Huawei Technologies Co.’s latest smartphones carry a version of the advanced made-in-China processor it revealed last year, independent analysis revealed, underscoring the Chinese company’s ability to sustain production of the controversial chip.

The Pura 70 series Huawei unveiled last week sports the Kirin 9010 processor, consultancy TechInsights found in a teardown of the device. That’s a newer version of the Kirin 9000s made by Semiconductor Manufacturing International Corp. for the Mate 60 Pro, which alarmed officials in Washington who thought a 7-nanometer chip beyond China’s capabilities. (…)

US officials are now weighing additional sanctions intended to ring-fence the company and China’s semiconductor ambitions more broadly. (…)

For Huawei, it’s another step toward rebuilding a consumer business devastated by Trump-era sanctions. The company was roughly on par with Apple Inc. in terms of Chinese market share in the first quarter, underscoring the way it’s eroded the iPhone maker’s domestic market share in past months.

Japan Tightens Export Controls on More Chip and Quantum Tech

Japan said it plans to expand restrictions on exports of four technologies related to semiconductors or quantum computing, the latest in a global push to control the flow of strategic tech.

Tokyo’s new measures will affect scanning electron microscopes, used to analyze nanoparticle images, and gate-all-around transistors, a technology embraced by Samsung Electronics Co. to improve semiconductor design. Japan will also require licenses for shipments of cryogenic CMOS circuits used in quantum computers, as well as for quantum computers themselves. (…)

Last year, Japan expanded restrictions on exports of 23 types of leading-edge chipmaking technology. That measure came on the heels of US efforts to limit China’s access to key semiconductor processes. Washington officials have lobbied international partners like Japan and the Netherlands to match its trade sanctions on China, which the US sees as a geopolitical and potentially military rival.