PENT-UP OR SPENT-UP?

Friday’s consumer spending release did little to tilt the debate one way of the other as bad weather in much of the U.S. likely kept many consumers indoors.

Interestingly, however, after 12 months, Wages and Salaries are back to their pre-pandemic level, even with 9.5 million fewer people working. By comparison, it took 40 months to revisit the October 2008 peak during the GFC which cost 8.7 million jobs at its worst point. Considering that 8.4 of the 9.5 million fewer working people are in Service-Providing sectors, the economic re-opening should bring Wages and Salaries closer to the trend line by the end of 2021. If so, labor income could be up as much as 8.0% YoY by the end of the year.

Consumer spending, which tends to closely track labor income, was down 1.0% MoM in February and is 0.6% below pre-pandemic levels. Spending on Goods declined 3.0% MoM in February following its 8.4% jump in January. It has declined in 4 of the past 5 months but is still up 5.5% annualized (nominal) for the period.

Taking into account Federal rescue money, disposable income is up 5.0% YoY during one of the worst recession. KKR estimates that the average American household’s disposable income rose 4.6% in 2020 and will rise another 4.8% in 2021 despite the surge in unemployment. Add $2.5 trillion in extra savings by the end of 2021 (17% of pre-pandemic annual consumption spending) and one can only conclude that the consumer sector will remain a driving force for the economy for several years.

Not all of those dollars will get spent at once, but we do think they will support a multi-year expansion. Much of the extra savings have built up at the high end, as lockdowns have curtailed upper-income spending on travel and leisure. Excess savings should help catalyze big-ticket discretionary spending amid reopening.

At the lower end, high and sustained consumer demand could encourage employers to accept paying higher wages to attract hard-to-find labor as the economy re-opens. This is not only true in specialty manufacturing or in transportation. Many restaurant and retail groups have announced higher wage rates to retain and attract qualified workers. Last week:

Darden [Restaurants] said Thursday that starting next week, hourly restaurant employees will earn at least $10 an hour, including tips, instead of the federal minimum wage [$7.25] or state minimum wage. The company is planning to raise that floor to $11 per hour in January 2022, and $12 an hour in January 2023. The change will impact about 20% of hourly workers, according to the company. The move comes at a time when Darden is trying to attract workers. Our greatest challenge right now is staffing,” Darden CEO Eugene Lee said on a call with analysts. (…) Staffing up is “our number one priority right now,” Lee said.

In reality, Americans will emerge from the pandemic in great financial shape:

- total disposable income is up well above inflation;

- swollen bank accounts and credit card balances down 12%;

- much lower interest rates on most other debt.

Thanks to “stimmy” checks and unprecedented money printing, real disposable income is set to have its biggest increase ever in any given six-quarter period, says Credit Suisse. The firm expects U.S. consumption to surge an “extreme” 10% this year, triggering a significant jump in new orders and new hiring—all of which is highly inflationary. This month, in fact, U.S. manufacturers reported the sharpest rise in new orders since 2014, according to IHS Markit. (Via US Funds)

The other debate is about inflation. Larry Summers on Bloomberg last week:

“If you were looking to un-anchor inflation expectations, having the Fed chair say the Fed’s going to have a new regime and is no longer sure that overheating the economy leads to inflation, and having the administration say we’re in an entirely new progressive era where policy is going to differ radically from what it has been for the last 40 years — those would seem like the best things you could do if you were trying to un-anchor expectations,” he said.

KKR’s Henry McVey:

If there was ever a time to talk about inflation, now is that time. We have record money supply growth, a dovish Fed, and a new Secretary of Treasury who may be even more dovish than the current Fed chair. (…) inflation risk is clearly the issue most heavily weighing on investors’ psyches.

But Friday’s data release did nothing to boost inflation expectations:

A key measure of inflation was mostly muted in February. The price index for personal-consumption expenditures, the Federal Reserve’s preferred inflation gauge, rose 1.6% last month from a year before, the Commerce report showed. That was slightly faster than the 1.4% annual rise in January, and the largest year-over-year increase since February 2020.

After excluding volatile food and energy components, however, the so-called core index was up just 1.4% in the year ended in February, which was slower than the 1.5% year-over-year increase in January.

The Atlanta Fed’s Underlying Inflation Dashboard:

PCE Durable Goods prices, still up 1.0% YoY (+3.3% per the CPI), declined 0.1% in February and have declined in 4 of the last 6 months. Market-based core PCE prices are not accelerating and are up only 1.4% YoY in February, essentially unchanged during the last eight months.

Curiously, CPI-Durables did not drop in March and April 2020 unlike PCE-Durables, largely explaining the current gap in YoY measures. In the last 5 months, prices of PCE-Durables are off 0.25% while prices of CPI-Durables are flat.

Investor angst is really focused on goods inflation given rising commodity prices, supply and supply chain issues and very low inventories. But the evidence so far does not support runaway goods inflation, perhaps because merchants have been able to offset these cost increases with higher volume and increased productivity.

S&P 500 companies reported revenues up 2.7% in Q4’20, materially above expectations, particularly for consumer-sensitive sectors. Q1’21 revenues are seen up 8.6% (+10.1% ex-Energy). Profits, up 3.8% in Q4’20, are forecast up 23.9% in Q1’21, again materially above previous expectations.

Now, Goldman informs us that since “it takes several quarters for upstream costs to be reflected in consumer prices, overall core PCE inflation probably does not yet fully reflect higher commodity costs and industrial goods prices. (…) upstream input prices tend to lead core goods prices by 2-6 quarters.”

If so, the hit to inflation, or to profit margins, should begin in Q2 or Q3. So far, corporate pre-announcements for Q1 are better than they were for Q4’20. It will be interesting to hear forward guidance in the next few weeks.

Meanwhile, the economy is gradually re-opening (charts from GS and US Global Investors):

Fridges, microwaves fall prey to global chip shortage A global shortage of chips that has rattled production lines at car companies and squeezed stockpiles at gadget makers, is now leaving home appliance makers unable to meet demand, according to the president of Whirlpool Corp in China.

Economists bullish on Biden’s $3T infrastructure plan (Axios)

Economists are becoming positively giddy about the potential for economic growth this year as President Biden and Congressional Democrats look set to push forward a $3 trillion infrastructure bill.

“Stimulus helps build the bridge for the recovery to reach the other side, but an investment in infrastructure is the fuel to jump start the economic engine,” Beth Ann Bovino, U.S. chief economist at S&P Global, says in an email.

- S&P predicts Biden’s infrastructure plan will create 2.3 million jobs by 2024, inject $5.7 trillion into the economy — which would be 10 times what was lost during the recession — and raise per-capita income by $2,400.

Economists at Goldman Sachs again revised up their outlook for growth this year in a Sunday note to clients, predicting real consumption will grow by 9.5% in Q1 and 12.5% in Q2, citing retailer reopenings, the reversal of winter storm effects and a decline in new COVID-19 infections.

- Further, they note that OpenTable restaurant reservations are nearing 70% of normal nationwide and are back above their pre-crisis level in Texas.

- They also anticipate the pace of fiscal support to U.S. consumers will accelerate by $1 trillion on an annualized basis (or 5% of GDP) for March and the second quarter, relative to the previous six months.

Faster Inflation Is Coming. How Bad Will It Be? (Mohamed A. El Erian)

(…) While economists and the Fed would view a spike in inflation through a longer lens, markets might well end up living more in what Bloomberg’s Jonathan Ferro labels “the moment” — that is, reacting in the short term by rapidly taking bond yields higher and risking to destabilize stocks and other risk assets that have benefited enormously from the widespread market confidence in continuing ample and predictable liquidity injections. Coming at a time of excessive and, in some cases, irresponsible risk-taking, this could have adverse economic spillovers.

Such effects would be felt well beyond the U.S. Already, European Central Bank officials have complained about the “undue tightening” of euro-zone financial conditions because of higher U.S. bond yields. This has also contributed to a slowly widening cycle of interest rate increases by central banks in emerging economies. (…)

With that comes the risk of higher market volatility and, on the political front, the prospects of more heated congressional deliberations on economic and social well-being that could make subsequent fiscal packages harder to pass quickly notwithstanding their importance for a lasting U.S. recovery.

House Prices Are Inflating Around the World Pandemic-related stimulus, ultralow rates and changes in buyer behavior are turbocharging markets from Europe to Asia

In the 37 wealthy countries that make up the Organization for Economic Cooperation and Development, home prices hit a record in the third quarter of 2020, according to OECD data. Prices rose almost 5% on the year, the fastest in nearly 20 years.

(…) “It is clear that rising [house] prices of between 5% and 10% annually, depending on the market we are talking about, are not sustainable in the long run,” said Karsten Biltoft, assistant governor at the [Danish] central bank. (…)

Property prices are up 16% over the past year in the city of Shenzhen, for example. In New Zealand, authorities recently tightened mortgage lending standards, with median home prices climbing 23% in February from a year earlier to a record.

In Sydney, where property prices also recently hit records, new mortgage demand is so high that some banks are struggling to keep up, said Christian Stevens, senior credit adviser at mortgage brokerage Shore Financial. (…)

As in the U.S., much of the buying globally is being driven by real demand rather than speculation, with families looking to upgrade to larger properties in suburban areas as they work more from home. (…)

Canada’s central bank governor, Tiff Macklem, said in February there were early signs of “excess exuberance” in the Canadian housing market, with prices up 17% on an adjusted basis over a one-year period, according to the Canadian Real Estate Association. Mr. Macklem said officials would be monitoring the situation closely, but dismissed taking measures to rein in sales, saying the economy needed all the support it could get. (…)

In early March, the chairman of China’s main banking regulator said he was worried about a possible correction in home prices, which could threaten banks’ stability.

Europe’s housing prices have kept climbing despite a much bleaker economic outlook than in the U.S. or China. In part that is because governments have kept supporting families with salary subsidies and moratoriums on loan repayments. It is also because interest rates remain extraordinarily low, with mortgage rates averaging 1.35% across the eurozone. (…)

- Farmers Vie for Land as a Grain Rally Sparks Shopping Spree Prices to buy and rent U.S. farmland have been revived by rallying grain markets, historic government payments and low interest rates—and that has made it harder for smaller farmers to compete.

(…) Farmland values rose during 2020 as soaring grain prices last fall revived farmers’ fortunes, according to February reports from three regional Federal Reserve Banks. Land prices in the Chicago Fed region, which covers parts of Illinois, Indiana, Iowa, Michigan and Wisconsin, climbed 6% last year, the largest such increase since 2012, the bank said.

Many agricultural lenders surveyed by the banks expected farmland values to rise this year as well. A March survey of Iowa farmland specialists showed a statewide average of farmland values was up nearly 8% since September, according to Iowa’s chapter of the Realtors Land Institute. (…)

Competition among U.S. farmers for land is fierce partly because there is less to go around. (…) Fewer, bigger farmers now dominate the country’s remaining 900 million acres, with 75% of farmed cropland controlled by about 13% of farms, the data show. (…)

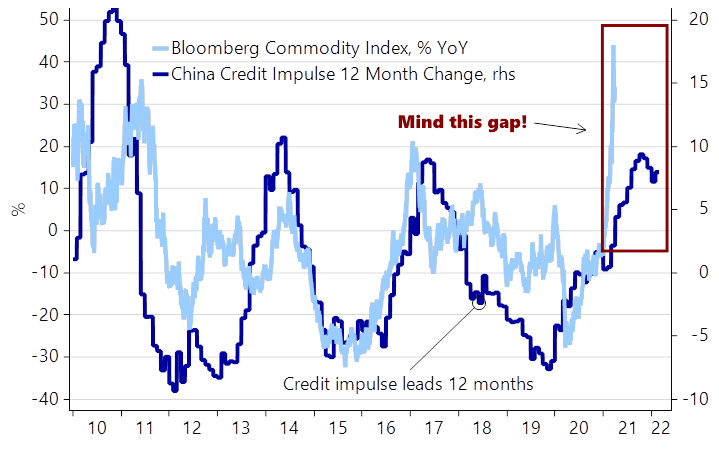

China Helped Rev Up, Then Slow Down, the Commodities Boom Nearly a yearlong bull run among industrial metals is faltering as the unwinding of a stimulus in China slows demand, underscoring the increasingly pivotal role its state-led economy plays in global commodity booms.

(…) China, which accounts for as much as 60% of the world’s resource consumption, has in recent weeks pulled back from its investment-led playbook, as policy makers refocus on containing bad loans and retooling the economy onto a consumer-led footing. Amid fresh concern that some battery-making metals could be globally oversupplied, benchmark metals fell in March from records a month earlier—nickel by 18%, cobalt 13% and copper 9%. (…)

Among the most tightly supplied of such metals globally is copper. But even so, copper imports to China had eased by December off midyear highs, down 9% that month compared with November. Imports of lithium-cobalt oxide, the bluish-gray crystal used in rechargeable battery electrodes, were down 14% for the year compared with 2019. Nickel ore imports in 2020 fell 30% year over year. (…)

In early March, nickel prices, which had soared for months on China’s projected battery demand, plummeted 9% in a single day, hours after Chinese metal producer Tsingshan Holding Group announced plans to cheaply supply large volumes of nickel matte, a battery ingredient, to Chinese battery makers—damping industrywide expectations of battery-grade nickel shortages.

Also weighing on prices: U.S. miners are racing to develop new supplies of lithium, in part to lessen dependence on China, which analysts estimate controls around half the world’s lithium output and makes three-quarters of its lithium-ion batteries. (…)

“Can China continue to demand the same amount of commodities? To me, the answer is no, because its structural growth is coming down,” Ms. Garcia-Herrero said. “This doesn’t bode well for supercycle.”

Is the so-called commodity super cycle running on fumes already?

(Nordea)

Lower commodity prices would help the “inflation transitory” team:

Pandemic Accelerates Retirements, Threatening Economic Growth The proportion of older workers participating in the labor force is hovering at its worst level since the onset of the coronavirus pandemic, potentially impairing economic growth.

The labor force participation rate—the proportion of the population working or seeking work—for Americans age 55 and older has fallen from 40.3% in February of 2020 to 38.3% this February—representing a loss of 1.45 million people from the labor force.

The participation rate initially fell much more for prime-age workers, those between ages 25 and 54, from 82.9% in February last year to 79.8% in April, but has since jumped 1.3 points, to 81.1% in February of this year. By contrast, participation for older workers has shown no rebound from last spring. (…)

Many of these workers appear to have retired and thus may not return even when the public-health crisis is over. The proportion of the working-age population not in the workforce due to retirement rose to 19.3% in the fourth quarter of 2020 from 18.5% a year earlier, just before the pandemic, according to government data compiled by the Federal Reserve Bank of Philadelphia.

That is roughly 2.4 million workers who left the labor force due to retirement since the pandemic’s onset, more than double the number who did so in 2019, according to Ms. Boussour’s analysis. (…)

That decline is especially worrisome because it comes as an aging population has already been holding down growth in the U.S. labor force. Economic output depends on the number of workers and how productive each worker is. Thus, the decline in participation, if not reversed, could weigh on growth. (…)

There will be impacts on growth but also on productivity and wages.

Suez Container Ship Is Partially Freed Engineers partially freed a wedged ship blocking the Suez Canal and tug boats were working to straighten its course, an effort that could soon reopen the vital trade route and end days of global supply disruptions.

MARGIN CALL

MARGIN CALL

Stock Futures Drop as Banks Warn of Losses S&P 500 futures edged lower after Archegos Capital unwound billions of dollars in holdings, triggering concerns that banks who dealt with the firm could face sharp losses.

(…) Global investment banks Credit Suisse Group and Nomura Holdings on Monday said they could incur substantial losses from dealings with a U.S. client. Neither bank named its respective client. Shares in some global banks fell as investors grew worried that more financial intermediaries may struggle to recoup money loaned to this client. (…)

Morgan Stanley, Goldman Sachs Group and Deutsche Bank unloaded large blocks of shares for Archegos last week. According to people familiar with the fund, the highly leveraged Archegos took big, concentrated positions in companies and held some positions via swaps. Those are contracts brokered by banks. (…)

(…) Much of the leverage used by Hwang’s Archegos Capital Management was provided by banks including Nomura Holdings Inc. and Credit Suisse Group AG through swaps or so-called contracts-for-difference, according to people with direct knowledge of the deals. It means Archegos may never actually have owned most of the underlying securities — if any at all.

While investors who build a stake of more than 5% in an U.S.-listed company usually have to disclose their position and future transactions, that’s not the case with stakes built through the type of derivatives apparently used by Archegos. The products, which are made off exchanges, allow managers like Hwang to amass stakes in publicly traded companies without having to declare their holdings. (…)

While the margin calls on Friday triggered losses of as much as 40% in some shares, there was no sign of contagion in markets broadly on Monday. (…)

As well as their secrecy, equity swaps and CFDs grew in popularity among hedge funds because they are exempt from stamp duty in high-tax jurisdictions such as the U.K. Banks like them because they can make a large profit without needing to set aside as much capital versus trading actual securities, partly a consequence of regulation imposed in the aftermath of the global financial crisis.

Regulators in Europe have begun clamping down on CFDs in recent years because they’re concerned the derivatives are too complex and too risky for retail investors. In the U.S., CFDs are largely banned for amateur traders. (…)

TECHNICALS WATCH

My favorite technical analysis firm remains positive while acknowledging that continuing short-term gyrations could be unnerving to many. Selling pressure has increased since Mid-February even with rising equity prices. Not problematic so far but an indication that more investors are finding reasons to trim exposure.

But the “broadening market” theme seems at risk:

The latest data points on retail trading from Charles Schwab show that retail trading activity has declined for the 3rd consecutive week, down 7% last week, following 13% and 5% declines in the prior two weeks. Trading activity is now 30% below late January peak levels on Charles Schwab’s platform. MS QDS team report that their retail proxy metrics indicate that option volume is down and premium spent on calls via small orders (odd lots) is also down recently. Perhaps, we may have seen the peak of the retail hand in markets, as businesses are slowly beginning to re-open and people go back to work they will have less time / fewer resources to sit at home and undoubtedly trade. (The Market Ear)

- Gone with the wind – SPAC first day pops.

- Robinhood Trader’s Battle Cry: ‘It’s All Just a Game to Me’ Traders who boast about their own cluelessness are upending the traditional investing hierarchy. It probably won’t last.

(…) “I don’t know what the f— I’m doing,” a young man said in a TikTok video in January. “I just know I’m making money.” He added that he’d been trading stocks for only three days, but “just like that, made $300 for the day.” In the next few weeks that young man, Danny Tran, racked up roughly 500,000 followers on TikTok.

At the WallStreetBets forum on Reddit, the online chat community, comments like “I can’t read” and “I have no idea what I’m doing” are common. Users insult each other’s—and their own—intelligence as terms of endearment and badges of honor. In February, commenters on WallStreetBets called themselves “stupid,” “idiot” or related terms 3,550 times, according to TopStonks.com, which tracks stocks mentioned on Reddit and other sites. (…)

As of March 23, 95.9% of the slightly more than 3,000 stocks in the Wilshire 5000 Total Market Index had a positive total return over the prior 12 months, according to Wilshire. No other one-year period has come close to that since the end of February 2004, when 93% of stocks had positive 12-month returns. (…)

The expected value of a lottery ticket is generally less than 65 cents on the dollar. Casinos, sports-betting websites and online gaming outfits take less “vigorish” as their cut, but on average the house always wins. Most bettors know that, but no one minds—because the hope of winning is so exciting, no matter the odds.

Now that just about anybody can trade commission-free, gambling on stocks offers a much better chance of making money than other kinds of wagers.

(…) A stock is much more fun than a lottery ticket, which is static and which assures that you will almost always lose.” (…)

“The majority of the time I’m winning, with barely any knowledge, so it’s been a fun process,” he says. “Knowing what you’re doing would always be good, but in this market anything is possible.” (…)

![]() Summertime,

Summertime,

And the livin’ is easy

Fish are jumpin’

And the cotton is high ![]()

TESTING, TESTING!

TESTING?

U.S. fears China attack on Taiwan (Axios)

“The US is concerned that China is flirting with the idea of seizing control of Taiwan as President Xi Jinping becomes more willing to take risks to boost his legacy,” the Financial Times reports (subscription).

- A senior U.S. official told the FT the Biden administration had reached the conclusion after assessing Chinese behavior during the past two months.

An invasion of Taiwan, the self-governed island claimed by Beijing, would force the U.S. to decide whether to go to war with China to defend an implicit ally.

- After a show of force by Chinese bombers off Taiwan just after President Biden took office, the State Department said: “We urge Beijing to cease its military, diplomatic, and economic pressure against Taiwan.”

Adm. John Aquilino, nominee to head U.S. forces in the Pacific, warned the Senate Armed Services Committee this week that the threat to Taiwan “is much closer to us than most think,” CNN reported.

- China views taking control of Taiwan as “their No. 1 priority,” Aquilino said.

Adm. Philip Davidson, current head of the U.S. Indo-Pacific Command, testified earlier this month that the Chinese military is building up offensive capability, making the threat to Taiwan “manifest during this decade — in fact, in the next six years.”