Personal Income and Outlays, March 2021

Full BEA release here.

The JP Morgan Chase card spending tracker through April 24: +10.7% over 2 years ago.

The Goldman Sachs Analyst Index (GSAI) rose 5.8pt to an all-time high of 79.2 in April (Exhibit 1). The composition of the survey was strong, as the orders, shipments, and employment components all increased.

-

Other major business activity surveys were very strong in April.

-

Roughly ¾ of surveyed sector analysts report that business activity in their industry is at or below pre-virus levels, but about 60 percent said they expect demand in their industry to overshoot pre-virus levels in 2021, on average by 0–10%.

U.S. Initial Unemployment Insurance Claims Fell Further

Initial claims for unemployment insurance continued to decline in the week ending April 24, falling to 553,000, down 13,000 from the prior week’s 566,000 (revised up from 547,000). The Action Economics Forecast Survey panel expected that 563,000 new claims would be filed. The latest week’s figure represents yet another new low since the pandemic started in March 2020, even though it is still well above pre-pandemic levels. The 4-week moving average fell to 611,750 in the week ended April 24, also a pandemic low, from 655,750 the previous week.

Initial claims for the federal Pandemic Unemployment Assistance (PUA) program fell to 121,749 in the April 24 week, down from 133,358 the week before. Still, these are both the smallest since April 11, 2020, right after the program began. The PUA program provides benefits to individuals who are not eligible for normal state unemployment insurance benefits, such as the self-employed. Given the brief history of this program, these and other COVID-related series are not seasonally adjusted.

Continuing claims for regular state unemployment insurance edged up 9,000 to 3.66 million in the week ended April 17 from 3.65 million in the previous week (revised from 3.67 million). The state insured rate of unemployment was unchanged at 2.6%. The 2.6% rate is also the lowest since the pandemic started; it was as high as 15.9% in May 2020.

Continuing PUA fell markedly in the week ended April 10, to 6.97 million from 7.31 million. Still, this is the lowest since the first few weeks of the pandemic period, except for a temporary dip during the week between Christmas and New Year’s. Also in the April 10 week, the number receiving Pandemic Emergency Unemployment Compensation (PEUC) fell sharply to 5.19 million from 5.61 million in the prior week. This program covers people who have exhausted their state benefits.

The total number of all state, federal, and PUA and PEUC continuing claims fell to 16.01 million in the week ended April 10, down 823,000 from the previous week. This is also the lowest since very early in the pandemic period, except for the week after Christmas. This grand total is not seasonally adjusted.

U.S. Pending Home Sales Rebound in March

Pending home sales increased 1.9% (23.3% y/y) during March following an 11.5% February fall, revised from -10.6%. According to the National Association of Realtors (NAR), recent sales weakness continued to reflect a record low number of homes on the market.

Sales in the Northeast jumped 6.1% (16.7% y/y) following two months of sharp decline. Sales in the South rose 2.9% (27.9% y/y) after a 12.9% drop in February. In the West, sales also gained 2.9% (29.8% y/y) after declining for two straight months. Moving 3.7% lower (+14.1% y/y) were sales in the Midwest, down for the fifth straight month.

MANUFACTURING PMIs

China: Manufacturing PMI picks up to four-month high in April

Latest survey data indicated that growth momentum picked up across China’s manufacturing sector in April, with firms reporting the strongest increases in output and sales for four months. This supported renewed expansions in employment and purchasing activity. However, the time taken for inputs to be delivered continued to lengthen amid reports of material shortages and logistical delays. Prices data meanwhile showed that higher raw material costs led to a steeper increase in input prices, which were generally passed on to clients in the form of higher charges.

The headline seasonally adjusted Purchasing Managers’ Index ™ (PMI ™ ) rose from an 11-month low of 50.6 in March to 51.9 in April. This signalled the strongest improvement in the health of the sector since December 2020, albeit one that was modest overall.

Total new orders rose for the eleventh month running in April, with manufacturers widely commenting on improved market conditions and greater customer demand. Though mild, the rate of growth was the strongest in 2021 to date, and supported by a further upturn in export sales.

The sub indexes for output and total new orders both reached the highest in four months. Overseas demand remained strong although some countries suffered resurgences in Covid-19cases. New export orders expanded month-on-month for the second straight month and the pace of expansion picked up.

Greater inflows of new work led goods producers in China to expand production volumes again in April, with the rate of expansion also improving to a four-month high.

The sustained increase in sales also led to a further accumulation in backlogs of work, with the rate of growth picking up since March. Consequently, manufacturers added to their staff numbers for the first time in five months. Though only marginal, the rate of job creation was the second-fastest seen in over eight years.

Goods producers in China also upped their purchasing activity in order to support higher production volumes. Though moderate, the rate of expansion was the steepest seen since December 2020. On the inventories front, stocks of inputs were broadly stable, while inventories of finished items fell modestly.

The time taken for purchased inputs to be delivered continued to lengthen in April, and to a greater extent than in March. Firms frequently mentioned that raw material shortages and logistical delays had driven the latest decline in vendor performance.

Prices data showed a further rapid increase in input costs amid reports of supplier price hikes (with metals and chemicals mentioned in particular). Notably, the latest increase in expenses was the quickest since November 2017. As part of efforts to alleviate pressure on margins, companies often passed on higher costs to customers through higher factory gate charges, which rose sharply overall.

Output expectations remained markedly upbeat in April, despite the level of positive sentiment edging down to a three-month low. Hopes of an end to the COVID-19 pandemic and the release of pent up demand, alongside new product releases, reportedly drove confidence. (…)

Policymakers have expressed concerns about rising commodity prices on several occasions and urged adjusting raw material markets and easing businesses’ cost pressure. In the coming months, rising raw material prices and imported inflation are expected to limit policy choices and become a major obstacle to the sustained economic recovery.

- China’s Economic Recovery From Covid-19 Shows Signs of Slowing Official gauges across China’s economy fell short of expectations in April, hit in part by semiconductor shortages, suggesting that the economy’s strong pandemic bounceback is starting to lose some momentum.

China’s official purchasing manager’s indexes showed manufacturing activity falling more sharply than expected, dropping to 51.1 in April, according to data released Friday by the National Bureau of Statistics—lower than March’s 51.9 reading and falling short of the 51.6 median forecast expected by economists polled by The Wall Street Journal. (…)

China’s nonmanufacturing PMI, which includes services and construction activity, fell to 54.9 in April from March’s 56.3 level. The subindex measuring business activity in the service sector fell to 54.4 from March’s 55.2.

FYI from Nordea:

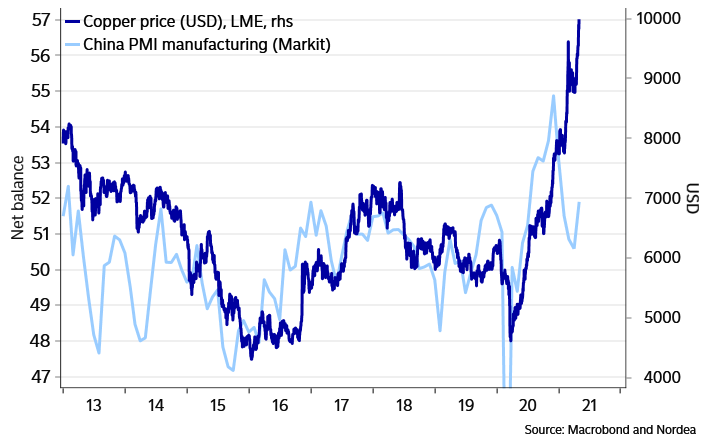

Copper prices wildly outpacing Chinese PMI

Japan: Manufacturing PMI reaches highest level for three years

The Japanese manufacturing sector registered the strongest improvement in operating conditions in three years, according to the latest PMI® data. Firms reported the fastest expansions in production and incoming business since early-2018, as demand and confidence continued to recover from multiple waves of COVID-19 infections. At the same time, additional production requirements encouraged manufacturers to increase employment levels for the first time since December 2020. As a result, Japanese manufacturing firms expressed a stronger degree of positive sentiment regarding the year-ahead outlook for output.

At 53.6 in April, the headline au Jibun Bank Japan Manufacturing Purchasing Managers’ Index™ (PMI) rose from 52.7 in March. This indicated the strongest improvement in the health of the sector since April 2018, which reflects a steady recovery from COVID-19 related disruption.

The improvement in the headline index was supported by a solid expansion in production volumes. Output increased for the third consecutive month in April, and at the fastest pace since April 2018. Firms linked growth to the ongoing recovery in demand, which led to increased orders for manufactured goods.

New orders, meanwhile, rose further in the latest survey period, with the pace of the expansion the fastest recorded for 38 months. According to anecdotal evidence, client confidence had continued to lift in both domestic and international markets. Furthermore, new export sales increased for the third month running, and at the quickest pace since February 2018 as demand improved in key markets, notably China.

At the same time, employment levels returned to expansion territory for the first time in four months in April. The rate of job creation was only marginal overall, yet it was the fastest recorded since February 2020. Firms noted higher capacity requirements due to increased orders, as well as taking on new graduates. In line with the trend in new orders, outstanding business rose for the second successive month. The pace of expansion was moderate overall, and the sharpest in just over seven years.

There were further reports that rising raw material prices placed sustained pressure on average cost burdens across Japanese manufacturers in April. Input prices have now risen in each of the last 11 months, with the rate of inflation quickening to the fastest since November 2018. Output prices, meanwhile, increased for the fifth month in a row, as firms sought to partially pass higher input costs to clients.

As output and orders continued to expand, buying activity increased for the second successive month. Moreover, the rise was moderate overall and the fastest reported for three years. Manufacturers in Japan noted ongoing difficulties in sourcing raw materials due to global shortages as well as some disruption caused by the fire at the Renesas chipmaking facilities and Suez Canal blockage. As a result, businesses utilised existing stocks of both inputs and finished goods.

Finally, business confidence regarding activity over the coming 12 months gathered pace in April. Positive sentiment was at its second-highest level since the survey first posed the question in July 2012. Optimism was underpinned by hopes of a broad economic recovery once the pandemic subsided.

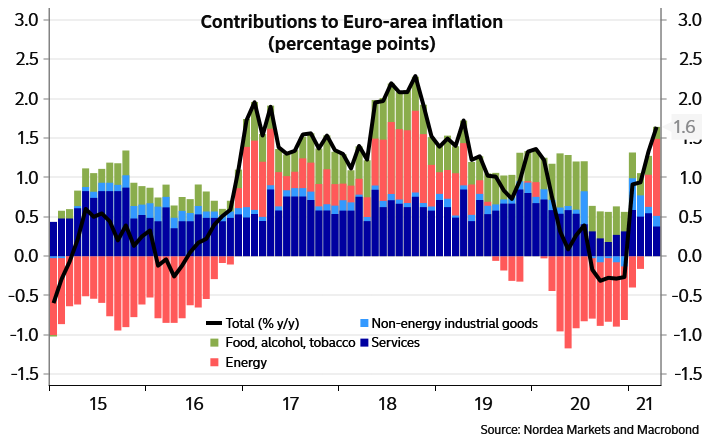

EUROZONE INFLATION

Euro-area headline inflation jumped from 1.3% to 1.6% in April. Most of the increase inflation is due to the base effect from the oil price. Otherwise, the inflation outlook is much cooler and core inflation declined to 0.8% from 0.9%. Both numbers hit the consensus.

Most headline inflation stemming from the oil price

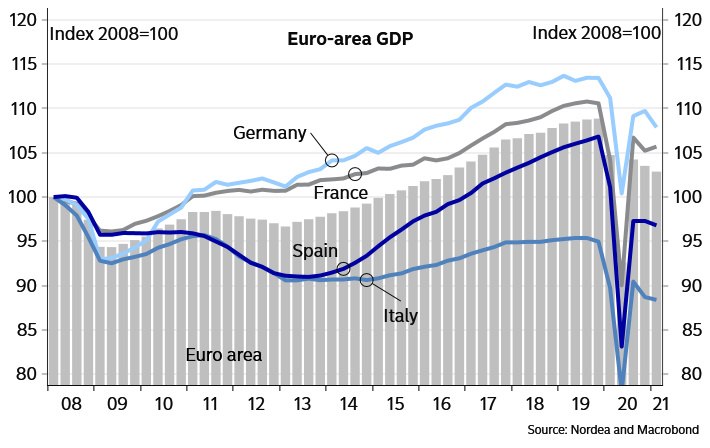

The Euro-area GDP 6% below the pre-crisis level (USA: -0.9%)

INFLATION WATCH

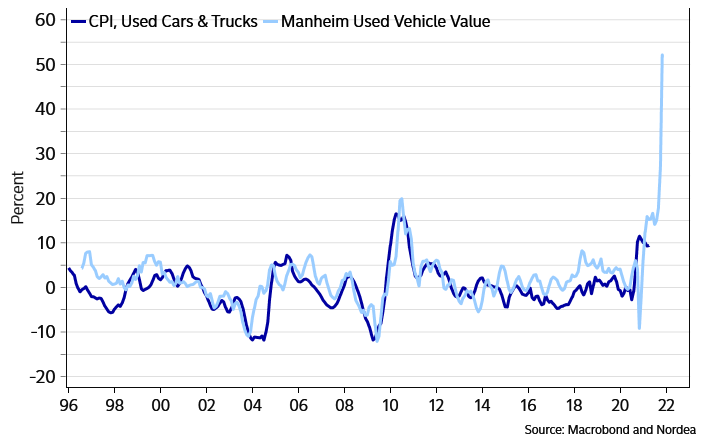

The average used vehicle is now worth $17,609, according to Manheim’s Used Vehicle Value Index. Pickup trucks, in particular, are fetching much higher prices than they were worth just a few months ago, Felix writes.

- The supply-and-demand dynamics are unlikely to change soon. The chip shortage is ongoing and has caused Ford, the maker of the best-selling vehicle in America, to cut its Q2 production by 50%.

Trade-ins are now becoming very difficult. Normally, dealers buy an old vehicle at a discount to what it’s worth and hope to sell it at a profit.

- Now, they need to worry that the whole market will crash from its current frothy highs.

Even Jay Powell must keep track of used car prices. Nordea says “This alone could perhaps push up core inflation by one percentage point late in the third quarter of this year”.

- Mondelez International Inc. plans to “price away inflation,” according to comments made after reporting first-quarter results on Tuesday. Judging by the pace of crop-price increases, other food makers may have to follow suit. The Bloomberg Agriculture Spot Index’s annual rate of change surpassed 75% this week for the first time since June 2011. In the process, the index came within striking distance of the biggest year-to-year advance in its 30-year history: 82.5%, recorded in March 2008. Strategists at Deutsche Bank AG highlighted the current surge in a note Wednesday. (Bloomberg’s Dave Wilson)

EARNINGS WATCH

- Some companies that surged during the pandemic are continuing to show strong growth, such as Amazon.com Inc., which reported a better-than-expected 44% increase in sales. Boat maker Brunswick Corp. saw revenue jump 48%; plumbing products maker Fortune Brands Home & Security Inc. is still benefiting from the boom in home building and renovation; and food stocks look set to defy the skeptics, our columnist says. (…)

- Other companies failed to inspire investors with their results. Twitter Inc. warned about lackluster user growth, sending shares lower in after-hours trading. Merck shares fell as profit slid amid competitive pressures.

- Supply-chain constraints are increasingly weighing on operations. Caterpillar Inc. signaled that a wave of issues, from the semiconductor shortage to global shipping problems, might make it harder to meet recovering demand this year. Mattress maker Tempur Sealy and Arm & Hammer maker Church & Dwight Co. also discussed supply constraints.

- Restaurants are benefiting from people eating there and ordering out. McDonald’s Corp. reported a jump in U.S. same-store sales, helped in part by new menu items and its drive-thru business. Domino’s Pizza Inc. is doing so well that it is trying to attract more drivers, a problem in a tight labor market. The parent of Outback Steakhouse highlighted strong sales momentum as dining restrictions eased.

It’s Short Squeezes All the Way Down Turns out one supply bottleneck is an opportunity, but too many of them is an obstacle

(…) what happens when short squeezes meet other short squeezes? Resolute Forest Products is one of the first sawmills to report this earnings season and it should have unveiled bumper revenue with lumber prices up 85% this year alone. Instead, the company reported earnings-per-share that came in below analyst expectations. Why? It seems the supply shortage in wood bumped into a supply shortage in transport. From the statement:

“The wood products segment generated operating income of $221 million in the quarter, a $93 million improvement from the fourth quarter, due to a $266 per thousand board foot increase in the average transaction price, or 44%, on strong lumber demand. But shipments fell by 50 million board feet because of seasonal shortage in rail cars and trucks, pushing finished goods inventory up by 46 million board feet, to 143 million board feet. The operating cost per unit (or, the ” delivered cost “) rose by $49 per thousand board feet, or 13%, reflecting a higher variable compensation provision, higher fiber costs and the CEWS credits received in the previous quarter. EBITDA in the segment improved by $93 million, to $232 million.”

Resolute Forest Products plunged 15%.

China Warns Large Tech Firms as Industry Faces Rising Oversight Tencent, ByteDance and JD.com were among the firms ordered to change business practices that regulators see as risky, the latest sign of heightened scrutiny of the sector.

China is reining in the ability of the country’s internet giants to use big data for lending, money-management and similar businesses, ending an era of rapid growth that authorities said posed dangers for the financial system.

On Thursday, China’s central bank and other regulators ordered 13 firms, including many of the biggest names in the technology sector, to adhere to much tighter regulation of their data and lending practices.

Their aim, say analysts, is to curb a revolutionary business model that let China’s Big Tech develop and use powerful payment apps and other information about hundreds of millions of users. (…)

An article published by the official Xinhua News Agency late Thursday said all 13 of the firms had agreed to rectify their business practices as required. (…)

The crackdown comes as China’s leaders make greater demands for its tech entrepreneurs to be aligned with the state’s goals and priorities.

These internet giants—armed with troves of data, deep coffers and an influence that spans all aspects of Chinese life—have increasingly made them a national-security concern for Beijing.

A statement released by the People’s Bank of China Thursday listed a number of “widespread problems” among the tech firms, including offering banking and other financial services without license, inadequate corporate governance and engaging in unfair competition. All 13 of the firms must “conduct comprehensive self-examination and rectification” of their businesses based on laws and regulations, it says. (…)

The regulators, spearheaded by Vice Premier Liu He, Mr. Xi’s economic captain, also want to subject all the big tech firms involved in financing to greater capital and reserve requirements as well as data regulations.

At the core of the fintech clampdown is their payment businesses, which have powered Chinese Big Tech’s forays into finance and have emerged as stiff competitors to state banks, which traditionally processed payments. (…)

Under the guidelines regulators released Thursday, the tech firms must “disconnect the improper connection between payment tools and other financial products.” The vague language indicates that the ability for the firms to channel funds from their payment apps into lending and money-management activities would be severely curtailed.

Regulators also want to limit the use of the payment apps by the corporate sector, which could significantly hurt the growth of the tech firms’ payment business. In addition, by trying to break what the central-bank statement calls control over data, the People’s Bank of China signaled its intention to get the tech giants to share their troves of consumer-credit data.

The regulators believe that the firms’ control over such data give them an unfair competitive advantage over small lenders or even big banks through swaths of personal information harnessed from their payment apps. Alipay, for instance, is used by more than 1 billion people and has voluminous data on consumers’ spending habits, borrowing behaviors and bill- and loan-payment histories.

“We’re seeing the beginning of what could be a fundamental shift in the model for fintech in China,” said Martin Chorzempa, a research fellow at the Peterson Institute for International Economics who specializes in China’s economy. “This seems to be an attempt to reverse course entirely from the China super app model that has proven so revolutionary.”

The Economist calls Taiwan the world’s most dangerous place

The U.S. “is coming to fear that it may no longer be able to deter China from seizing Taiwan by force,” The Economist writes (subscription). “Taiwan is an arena for the rivalry between China and America. … If the Seventh Fleet failed to turn up, China would overnight become the dominant power in Asia.”