Posted Sunday March 29: BEAR ESSENTIALS

Posted Sunday March 29: BEAR ESSENTIALS

Virus Update

Slowing a tiny bit but probably because of late and slow testing:

Number of specimens tested for SARS CoV-2 by CDC labs (N=4,750) and U.S. public health laboratories* (N=125,653)

§ Data during this period are incomplete because of the lag in time between when specimens are accessioned, testing is performed, and results are reported. Range extended from 4 days to 7 days on March 26.

The chart above is one of many FT charts and data freely available here.

- Cases world-wide topped 732,000, while the death toll surpassed 34,600.

- In most western countries case numbers have been increasing by about 33 per cent a day, a sign that other countries may soon be facing the same challenge as Italy.

- U.S. Deaths From Virus Could Be as Many as 200,000, Fauci Says

- Dr. Deborah L. Birx, the lead coordinator of the White House’s coronavirus task force, said that even with precautions and restrictions the government’s model estimated “between 80,000 and 160,000, maybe even potentially 200,000 people succumbing†to Covid-19, the disease caused by the coronavirus. She added that without any precautionary measures, the same models projected that 1.6 million to 2.2 million Americans could die from complications of the virus.

- The White House is extending social-distancing guidelines for another 30 days through the end of April. “Nothing would be worse than declaring victory before the victory is won,†Trump said Sunday.

- Even Mr. Trump, who for weeks sought to downplay the seriousness of the crisis, struck a decidedly more somber note over the weekend. He also revealed that a personal friend was sick. “He’s a little older and he’s heavy,†Mr. Trump said. “But he’s a tough person, and we went to the hospital and a day later he’s in a coma.†“The speed and the viciousness, especially if it gets the right person, it is horrible,†Mr. Trump added.

- Trump declares D.C. a ‘major disaster’ area (

Some say it’s been for a while…)

Some say it’s been for a while…) - Officials in South Korea, widely praised for its handling of the outbreak, warned that they were seeing a sustained increase in infections in and around Seoul. The country has seen a steady rate of new cases for almost two weeks, with roughly 100 new cases each day since March 11. The outbreaks in the Seoul region have been linked to a call center and a church that held services in violation of the government’s social distancing policy.

- Italy, with nearly 11,000 deaths, saw some hopeful signs as the mortality rate dropped for a third day in a row — from 969 to 889 to 756 — and new patients requiring critical care dropped to 50, from 124.

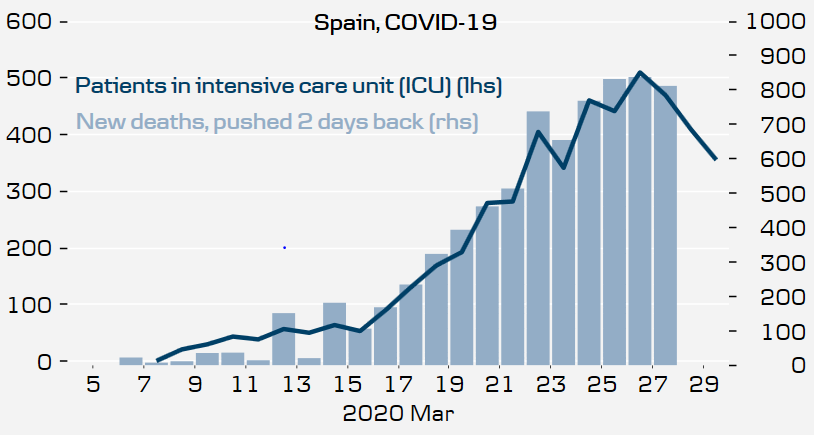

- Spain also announced 812 new deaths, bringing its national total to 7,340 — more than twice the official death toll reported by China, but still less than Italy’s.

- The total number of confirmed cases in Spain rose to 85,195 by Monday, whereas China had reported 82,356 by Sunday, according to the World Health Organization. New cases in China remain rare, despite concerns over imported infections and potential underreporting of asymptomatic carriers of the virus.

- Doctors Say It’s Only a Matter of Time Before Virus Sweeps India

- Africa Is Two to Three Weeks Away From Height of Virus Storm

- Abbott Laboratories shares rose 18% in U.S. pre-market trading after the company introduced a coronavirus test that can tell if someone is infected in as little as five minutes, and is so small and portable it can be used in almost any health-care setting.

- The two tests that will help to predict spread of Covid-19

- A consortium of manufacturing giants, including plane maker Airbus, defense giant BAE Systems and engine-maker Rolls-Royce Holdings, have agreed to build more than 10,000 ventilators amid a jump in demand from the spread of the new coronavirus outbreak. The VentilatorChallengeUK group, which also includes the U.K. operations of Ford Motor, packaged-goods giant Unilever, along with various Formula 1 teams, have agreed to combine forces to accelerate the production of a new ventilator design that can be assembled from parts in current production. Work is set to start this week.

- Smiths Group said it is contracting with the U.K. government to produce ventilators needed to treat critically ill coronavirus patients. The company plans to increase production to thousands of units a month from hundreds.

- Dyson announced last week it had developed a new ventilator and received an order from Britain for 10,000 units — but the government later said its purchase would depend on regulators approving the device.

- Canadian companies retool to meet demands on front lines of pandemic

- Authorities in Moscow ordered an indefinite citywide quarantine, compelling 12.7 million residents to remain in their homes.

- In Belarus, the authoritarian President Aleksandr G. Lukashenko called the coronavirus “nothing else but a psychosis†and has joked that a shot or two of vodka a day will poison the virus, advice rejected by medical experts.

- President Jair Bolsonaro of Brazil has also argued that concerns over the pandemic are overblown. He repeated his argument that the harm to the economy from efforts to curb its spread can be worse than the pandemic itself.

Outbreak at Washington state choir practice suggests virus had airborne spread

On March 10, 60 members of the Skagit Valley Chorale attended practice. Since then, two have died, three have been hospitalized, and 45 have either tested positive or shown symptoms of covid-19, the paper reported.

The outbreak was notable given that the singers, wary of the virus’s growing death toll in Seattle, were careful to use hand sanitizer, avoid physical contact and keep a distance from one another. None appeared to be ill at the time.

County health officials have concluded that the virus must have been transmitted through the air by singers who were asymptomatic, the Times reported. If so, it would bolster the findings of researchers who say that the virus can be transmitted through microscopic aerosols, in addition to the much larger respiratory droplets that are emitted when someone coughs or sneezes.

Chinese cinemas told to close just a week after reopening China Film Administration issues notice on Thursday as government seeks to prevent a new wave of Coivd-19 cases, after locally transmitted infection is reported in Zhejiang

(…) The infection was one of 55 reported across China that day, but the only one that was not imported, the report said. (…) While there have been sporadic cases of individual businesses being ordered to close soon after being allowed to reopen, a nationwide ban on an entire industry is unusual.

Earlier this month, a hotpot restaurant chain in Liaoning province was ordered to close all of its outlets just three days after being told it could reopen, when three new Covid-19 cases were found in the city of Dandong, according to Canyin88.com, which monitors the industry.

(…) In China’s official count of confirmed coronavirus cases, people who test positive but show no symptoms are excluded; they are added to the tally only if they start to feel sick. (…)

The Caixin commentary said revealing the scale and spread of asymptomatic cases was important for research and informing the public of continuing possible risks.

China has reported several days with no new cases outside those brought in from overseas. The case reported in Henan on Sunday suggests that the virus continues to spread among people who might not be included in the public tally. (…)

Caixin reported last week that thousands of urns were sent to funeral homes in Wuhan, the center of the outbreak, in recent days, raising questions about whether the death toll in the city could be higher than the official figure of 2,547.

Experts disagree on threat posed by asymptomatic coronavirus carriers

(…) Zhong Nanshan, one of China’s leading respiratory disease specialists, said in an interview with state broadcaster CGTN on Sunday that although asymptomatic virus carriers were “very infective because there is very high viral load in their upper respiratory tractsâ€, he did not think there were many of them. (…)

But not everyone is as optimistic as Zhong.

Speaking at a symposium in Shanghai on Friday, Zhang Wenhong, the head of the city’s Covid-19 clinical expert team, said that asymptomatic carriers “now pose the biggest risk†among imported cases of infection, of which Shanghai had reported more than 100.

“Asymptomatic coronavirus carriers usually have strong immunity and show no symptoms for more than two weeks despite being infected,†he said. (…)

Wang Xinhua, president of Guangzhou Medical University, said it was still too early to say what threat asymptomatic carriers posed.

“Confirmed cases with no symptoms do exist, but we don’t know the specific number and the workings and characteristics of this [type of] carriage are not clear,†he said.

“I think [in such people] the viral load is low and the virulence is weakened. If not, they would show symptoms.†(…)

PANDENOMICS

The Financial Times China Economic Activity Index

Using Wind’s financial database, we have compiled a weighted index of six daily, industry-based data series. The measures of the domestic economy include real estate floor space sales, traffic congestion within cities, and coal consumption in major power plants. Trade activity is represented by container freight. Two other indices, which have been given a lesser weighting, provide social and environmental context: box office numbers from Chinese cinemas – a good proxy on consumer activity – and air pollution in the ten largest cities.

After Three Stimulus Packages, Congress Already Prepping No. 4 Legislators are already roughing out the contours of yet another emergency-spending package to try to keep the crisis from turning into a 21st-century Great Depression.

Legislators from both parties, administration officials, economists, think tanks and lobbyists are already roughing out the contours of yet another emergency-spending package—perhaps larger than the last—to try to keep the coronavirus crisis from turning into a 21st-century Great Depression. Many expect the debate to begin in earnest by late April.

“There’s talk of a multi-trillion-dollar program, given the size of the shutdown,†says Stephen Moore, a fellow at the conservative Heritage Foundation. “There’s a general recognition that we need something big to get some juice into the economy,†adds Mr. Moore, an outside economic consultant to the Trump administration and some congressional Republicans.

The ideas being floated include extending last week’s package to make the benefits last longer, as well as plugging in likely holes in the hastily assembled bill. One item in particular cited by both President Trump and Democratic leaders is a desire for more money to shore up state government budgets collapsing under lost tax revenues and new spending demands.

A common theme from economists and legislators across the political spectrum: The latest measure was mainly about keeping U.S. commerce on life support while it endures a medically induced coma. That is, paying businesses and workers revenues and wages lost during the shutdown. A next phase would likely pivot from stabilization to stimulus—providing the patient a robust regimen of physical therapy in an attempt to get the economy back to full health. (…)

“My guess is that this bill won’t wear well over time, and Congress isn’t going to be inclined do another big package,†says Andy Laperriere, a Washington policy analyst with Cornerstone Macro, an investor advisory firm. “There will be fraud, companies getting money going into bankruptcy, things that people on the left and right won’t like.†(…)

“The left is going to want to do infrastructure, welfare payments and food stamps,†says Mr. Moore. “Our side will want to do tax cuts and deregulation.†(…)

Fed Considering Additional Support for State, Local Government Finance Central bank hires former Treasury official to assist with potential municipal-lending program

(…) Democratic lawmakers have made support for city and state borrowing a priority in recent legislative talks, and the latest bill directs the Treasury secretary to seek a Fed lending program for municipal finance. (…)

Under its governing law, the Fed can’t directly buy corporate debt, and it is limited to purchasing municipal debt of six months or less. But it can work around these restrictions by creating lending facilities that lend or purchase debt, subject to approval of the Treasury secretary. (…)

The Fed and Treasury brainstormed ways to support hard-hit state and local treasuries after the 2008 financial crisis, but opted against doing so. (…)

“There is a real reluctance to blur the line between the federal government and the state and locals. You start going down that road, it’s hard to know where to stop.â€

Bloomberg’s John Authers:

(…) when it comes to monetary bazookas, the Fed hasn’t gone anything like as far as the European Central Bank or the Bank of Japan in expanding its balance sheet. Now that it is effectively backstopped by the Treasury, it could go on quite a buying spree — which would, again, tend to weaken the dollar.

Coronavirus Heightens Risk of Emerging-Market Defaults About 18 countries’ dollar debt is trading at distressed levels, up from four nations at the start of the year

An unprecedented withdrawal of capital from emerging markets is threatening to create a wave of debt defaults as governments struggle with the double whammy of falling oil prices and the rapidly spreading coronavirus outbreak. (…)

Governments, already saddled with the high medical costs and the cost of shoring up their economies, could face a public backlash if they try to repay international bondholders when their local populations are suffering, Mr. Glossop said. (…)

The spread of coronavirus across Africa, South Asia and Latin America is likely to weigh heavily on the regions’ overstretched public-health systems. Measures to contain the outbreak, such as curtailing travel and business activity, will pose a crippling burden on the weakest economies, analysts said. For oil producers, who have seen the price of crude tumble by more than half to below $30 a barrel, that is a double whammy. (…)

The ICE Dollar Index, which tracks the dollar against a basket of currencies, this month climbed to its highest since January 2017. (…)

Oil Plummets to 17-Year Low as Broken Market Drowns in Crude

(…) The kingdom said on Friday that it hadn’t had any contact with Moscow about output cuts or enlarging the OPEC+ alliance of producers. Russia also doubled down, with Deputy Energy Minister Pavel Sorokin saying oil at $25 a barrel is unpleasant, but not a catastrophe for the nation’s producers. (…)

OPEC nations aren’t giving support to a request from the group’s president for emergency consultations over tanking prices, according to a delegate. Algeria, which holds the cartel’s rotating presidency, has urged the secretariat to convene a panel but the call has failed to gather the majority backing necessary to go ahead. Riyadh is among those opposing the idea. (…)

Global oil demand is in freefall and consumption may decline by as much as 20 million barrels a day, according to the International Energy Administration. That is forcing producers worldwide to slash output, while independent trader Trafigura Group expects as much as 1 billion barrels to be sent into storage tanks in the coming months. (…) For those without access to pipelines and ports, local storage will run out in days, traders and consultants say. (…)

In the U.S., one of the largest pipeline companies, Plains All American Pipeline LP, has asked oil producers to voluntarily cut output to avoid overwhelming the network that connects well heads to refineries through thousands of miles of pipelines. (…)

Many crudes, especially sticky, sulfurous grades that refiners find hard to process, trade at hefty discounts to international benchmarks. Western Canadian Select, a tarry blend squeezed from Alberta’s oil sands, reached a record low of $4.51 a barrel on Friday.

In the U.S., Oklahoma Sour is changing hands at $5.75, Nebraska Intermediate at $8, while Wyoming Sweet prices at $3 a barrel. (…)

The next stage of the oil market’s meltdown will be widespread production shutdowns as drillers decide the only option is to leave it in the ground until better days return. There are signs this is starting to happen.

Brazil’s state oil company Petrobras has announced it will reduce output by 100,000 barrels a day this year because of the lack of demand. In Canada, some producers have shut down output, and Glencore Plc., the world’s largest commodity trading house, has shut down its production in Chad.

Many producers are reluctant to shut wells because even though they’re losing money at today’s prices, some cashflow is often better than none at all. But as more refineries idle, the pipeline system grinds to a halt and storage tanks fill to the brim, they will soon have no choice.

Texas producers are beginning to receive requests from pipelines to reduce output as storage begins to run low, according to a tweet from Texas Railroad Commissioner Ryan Sitton. (…)

Here’s the tweet:

Got word yesterday that some Texas producers are starting to get letters from shippers (pipelines) asking for oil production cuts because they are out of storage. We need to get in front of this.

JPMorgan Says the Market Rout Is Probably Past Its Worst Now

(…) Coronavirus infection rates remain a “wild card,†as they remain high even if they’re “slowing†in the U.S. and Europe.

“Risky markets should remain volatile as long as infection rates create uncertainty about the depth and duration of the Covid recession, but enough has changed fundamentally and technically to justify adding risk selectively,†Normand wrote. “Most risky markets have probably made their lows for this recession, except perhaps oil and some EM currencies beset by debt-sustainability issues.†(…)

Goldman Sachs Group Inc.’s David Kostin reiterated in a note Friday that he expects the market to turn lower in coming weeks. He cited a checklist for a sustained rally similar to Normand’s — of slowing viral spread, evidence that fiscal and monetary policy stimulus is working, and a bottoming in investor positioning and flows.

Gavekal Research Ltd.’s Anatole Kaletsky said in a note Monday that it’s too early to buy equities, citing reasons including “surprisingly complacent†investor sentiment and historical data showing bear markets almost never end on a single massive sell-off without retesting the bottom. (…)

SENTIMENT WATCH

Normally, I would act on these 2 charts… but this is not a normal bear…That said, some companies are clearly being valued well below their true long-term value.

TO BE SHARED:

https://mvotd.com/pop-culture-covid-19-psa_c292fb0a2.html

TO BE WATCHED WITH FAMILY

(…) the best movie my family has streamed on Netflix has been Searching for Sugar Man, which won the Oscar for best documentary in 2012. It tells the incredible story of an American singer-songwriter who released two albums in the early 1970s, got dumped by his record label, and returned to his job as a construction worker in Detroit, all the time ignorant of the fact that he had developed a huge following in South Africa, where people thought he was “bigger than Elvis Presley.â€

It’s wonderful and moving, it entertains all the family (a rare feat), and it introduces some extraordinary music. Try listening to “I wonderâ€, and then wonder how this man did not get to be a household name. (John Authers)

Also worth watching: The Stranger on Netflix.