U.S. Job Openings, Quits Hit Records The Labor Department reported a seasonally adjusted 11.5 million job openings in March, as a shortage of available workers continued to pressure the U.S. labor market.

The Labor Department on Tuesday reported a seasonally adjusted 11.5 million job openings in March, an increase from 11.3 million the prior month. The number of times workers quit their jobs rose to 4.5 million in the same month, slightly higher than the previous record in November of last year. Meanwhile, hiring cooled slightly from the month before to 6.7 million hires in March. [-1.4% MoM, +8.5% YoY] (…)

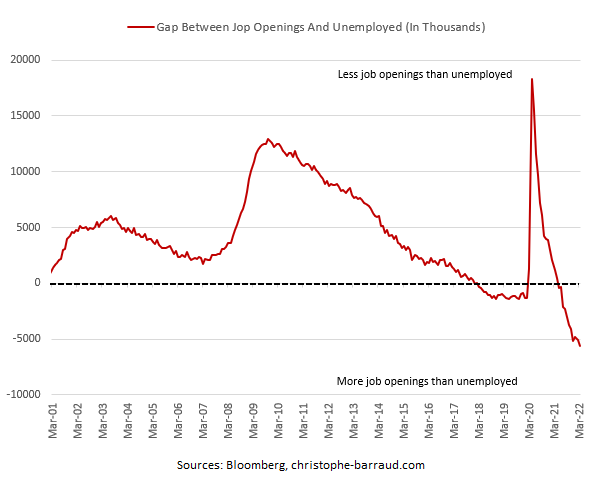

The number of job openings continues to exceed the number of unemployed people seeking work. In March, there were nearly two job openings for every unemployed person, according to the Labor Department. Openings have outpaced the level of unemployed people seeking jobs since last spring. (…)

The tight labor market has helped spur record compensation gains for workers, keeping pressure on inflation. Employees who switch jobs often win double-digit pay raises.

Average hourly earnings for workers in the private sector were 5.6% higher than the year before in March, rising significantly faster than the roughly 3% rate recorded the year before the pandemic began, according to the Labor Department. (…)

The difference between number of job openings and unemployed now exceeds 5.5M (@C_Barraud)

Hourly earnings growth accelerated for the eleventh consecutive month for workers of U.S. small businesses, according to the latest Paychex | IHS Markit Small Business Employment Watch. National small business job growth also remained strong, despite a slight moderation of 0.14 percent. The national jobs index for April was 101.14, an increase of 2.85 percent from a year ago. Average hourly earnings stood at $30.10, up 4.85 percent year-over-year. (…)

- After eight consecutive gains from June 2021 through January 2022, the national index held steady in February, moderated slightly in March (-0.03 percent) and April (-0.14 percent).

- At 99.54, Manufacturing slowed to below 100 for the first month since October 2021.

- After a slight downturn in January and February, weekly earnings growth quickly improved in March and April to a current rate of 4.39 percent. One-month annualized growth in March and April averaged 7.22 percent.

- Goldman Sachs:

After incorporating today’s data, the job-workers gap increased by 0.3pp to 3.4% of the labor force—or 5.6mn workers—in March, a new all-time high. This increased tightness suggests that strong wage growth will persist until improvements in labor supply and normalization of job openings bring the labor market back into balance.

U.S. Light Vehicle Sales Improve in April

The Autodata Corporation reported that light vehicle sales during April increased 7.5% (-21.1% y/y) to 14.59 million units (SAAR) after weakening 10.9% over the prior two months. Sales were 21.1% below the April 2021 peak of 18.50 million units. (…)

Trucks’ share of the light vehicle market fell to 78.5% in April and remained below the 80.4% share six months earlier.

Imports’ total share of the U.S. vehicle market improved slightly in April to 23.7% but remained well below February’s 25.4% share. Imports’ share of the passenger car market fell to 30.0% last month, its lowest level in five months and down from the September 2021 high of 38.1%. Imports’ share of the light truck market rose slightly to 22.0%. (…)

- CalculatedRisk tells us that Wards Auto released their estimate of light vehicle sales for April. Wards Auto estimates sales of 14.29 million SAAR in April 2022 (Seasonally Adjusted Annual Rate), up 6.9% from the March sales rate, and down 21.9% from April 2021.

INFLATION WATCH

- Global manufacturers are still able to pass their cost increases on to their customers, and then some…Unsustainable.

On one hand, a further rise in backlogs of work reflected the fact that supply delays meant new orders growth continued to run ahead of production growth globally in April, therefore suggesting some near-term support to production in coming months if supply constraints ease. On the other hand, the rises in backlogs in March and April have been the smallest since early 2021, even if China is excluded. This reduced rate of growth of uncompleted orders hints at a broader slowing production trend.

- Diesel prices are at record levels and U.S. natural gas prices yesterday rose to fresh 13-year highs as the commodity crunch marches on, Axios’ Ben Geman writes. Diesel costs are an inflationary force that pushes up prices for a range of goods. Similarly, natural gas prices affect industrial input costs, home heating and power.

Data: U.S. Energy Information Administration; Chart: Simran Parwani/Axios

- Starbucks Plans Barista Raises, Says Unionized Cafes Will Need to Bargain Coffee giant said labor and supply-chain costs are hurting margins, while price increases helped offset inflation

The Seattle-based coffee giant said Tuesday that it would invest roughly $200 million in stores and employees, including higher hourly pay, fixing cafe equipment, increased training, perks for highly skilled baristas and an app for better workplace communication. (…)

Around 240 of Starbucks’s 9,000 U.S. corporate stores have petitioned to unionize. As of Tuesday, Starbucks Workers United had won 46 elections, lost five and had undetermined results in three others, the National Labor Relations Board said. The federal agency had scheduled another 118 elections in coming weeks.

The additional spending Mr. Schultz outlined Tuesday includes Aug. 1 pay increases of at least 5% for baristas who have worked at Starbucks for two years or more, the company said. Baristas newer to the company will get pay bumps of least 3%, it said. Starbucks will also give one-time bonuses in August for store managers and other leaders.

Starbucks is working on allowing customers to directly tip employees when they pay by credit cards, one of the top requests from workers, Mr. Schultz said. (…)

- Shanghai Lockdown Reignites Supply-Chain Problems for U.S. Companies Some companies are warning that Covid-19 lockdowns are denting sales, disrupting operations and adding a strain that could be felt well into the summer.

- EU Proposes Sanctions on World’s Second Largest Fertilizer Maker

- China’s independent refiners start buying Russian oil at steep discounts

- EU Aims to Target Russia’s Global Oil Sales With Insurance Ban

- Inflation comes for coney hot dogs: Prices are rising for the iconic Detroit staple as restaurants grapple with increasing costs for ingredients, Joe Guillen reports in Axios Detroit, which debuted this week. After charging 99¢ for 17 years, Grandy’s Coney Island raised its price a few months ago to $1.10.

“Everything went up — chili, the bread, everything,” owner Gus Jaku says.

RBI Roils Markets With Surprise India Rate Hike Before Fed

EARNINGS WATCH

We now have 329 reports in, an 81% beat rate and a +7.1% surprise factor.

Q1 EPS are seen rising 9.3% vs 6.4% on April 1. Trailing EPS are now $213.90.

But Q2 estimates are now declining. Growth is now seen at 5.6%, down from 6.8% on April 1. Q3 and Q4 estimates are unchanged.

Corporate guidance is on the same pace as at the same time during the first quarter but the number of companies offering guidance is up 36%. Of the 13 additional companies having given guidance, 9 were guiding down.

BofA scores corporate sentiment: it’s as bad as in 2008!

Source: BofA Global Research (via The Daily Shot)

The worrying trend in Financials

(…) For investors in these stocks, the past few weeks have not been fun. It’s hard to find a Financial that’s even trading above its 50-day average. The percentage of stocks in the sector trading above their 50-day moving average just fell below 5% after diverging from index prices for much of the past year.

The total return in these stocks after fewer than 5% of them were trading above their 50-day average was not great. Across almost all time frames, returns were below random. Even including dividends, returns were about flat up to two months later, risk was about equal to reward, and there was a larger probability of a big drop than a big rise. This is unusual to see for a total return index over such a long time frame.

For the S&P 500 (price only, not total return), it was mostly a drag over the shorter-term, and didn’t have much of an impact past two months.

During unhealthy markets, we usually see the opposite – fewer than 40% of stocks tend to hover above their averages, and rallies above 60% tend to bring in sellers. For Financials, that’s what we’ve been seeing, with the percentage of members above their 200-day average falling below 40%. The recent spike above 60% was sold immediately. (…)

2 thoughts on “THE DAILY EDGE: 4 MAY 2022: Persistent!”

The graphical images associated with your rule of 20 explanations are absent within the body of the text for the posted links.

Bummer!! Thanks for the heads up. Will take care of it, actually will update it to the present. Needs a few days, however. Best. Denis

Comments are closed.