U.S. Small Business Optimism Falls to a Seven-Month Low

The National Federation of Independent Business optimism index slipped to 98.2 from 99.1, the lowest since March, the group said Tuesday. (…)

Inflationary pressures continue to build. A net 53% of owners reported raising prices, the most in monthly data back to 1986. More than half of respondents plan to increase prices in the next three months, also a record high.

The group’s measure of business conditions over the next six months fell to the lowest since November 2012. The share of firms who said now is a good time to expand declined to an eight-month low as rising material and labor costs dampen profits. (…)A record share of owners said they raised compensation and an unprecedented number are planning to in coming months as they seek to fill vacancies. Just under half reported job openings they could not fill, down slightly from September, but far above the measure’s historical average.

Some 39% of owners said supply-chain disruptions have had a significant impact on their business. A net 9% say inventory levels are “too low,” near a record high.

- Macy’s Boosts Its Hourly Wage to $15 Amid U.S. Labor Crunch Macy’s is also starting an education benefit program for workers that covers the cost of tuition, books and fees

Quarter of U.S. Workers Want Change by 2023, Keeping Churn Alive

A quarter of U.S. workers are considering a job change or retirement in the next 12 to 18 months, pointing to further churn in the labor market, according to a survey by Principal Financial Group Inc.

The share rises to 34% when accounting for respondents on the fence in their current roles, the survey showed. Employers shared the sentiment, with 81% concerned about strong competition for candidates. (…)

Among the reasons to change jobs are the stalwarts of seeking higher pay and a better career trajectory, but the pandemic has brought about new considerations. About a quarter want hybrid options, and retirement benefits are key for the 77% who say Covid-19 drove them to want to save more. (…)

Fed Officials Flag High Inflation and Some Warn of Rate Rises if Pressure Persists Several regional Federal Reserve Bank presidents said they expect today’s high levels of inflation to cool, but some added that if they don’t, the central bank might need to raise rates to help bring price pressures back in line.

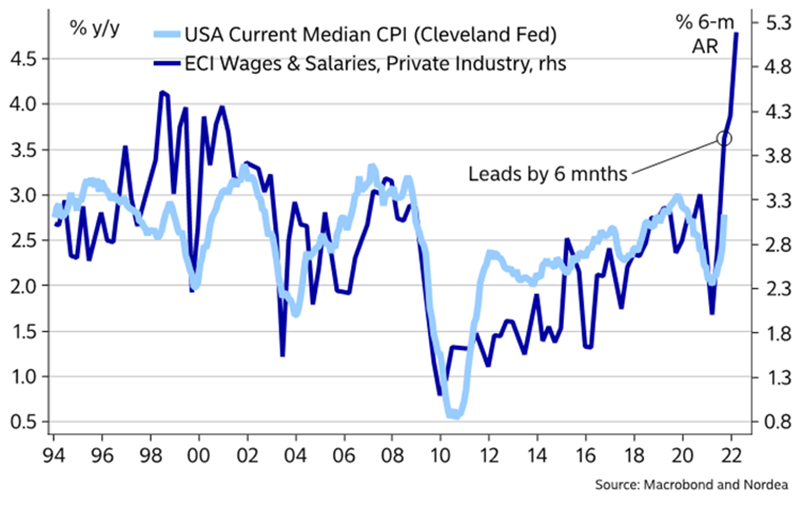

Broad wage growth usually spills-over to a higher median CPI with a time-lag of 6-9 months, which will likely lead median prices higher through 2022. This is exactly the kind of inflation that the Fed fears the most.

Wage pressure spill-over to broader price pressure with a time-lag

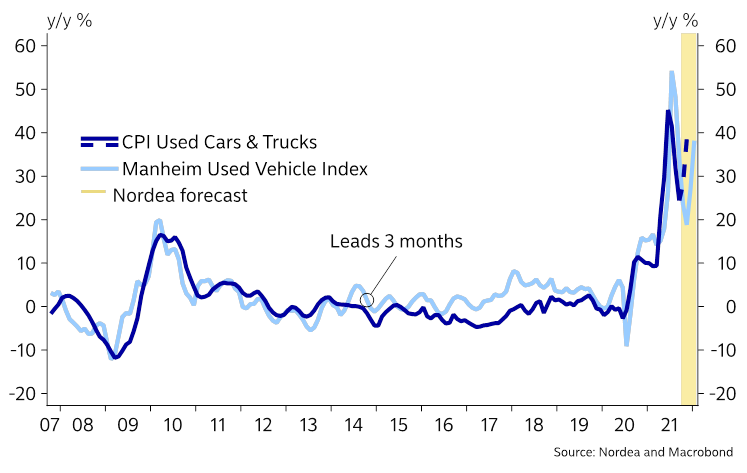

The old culprit behind the higher core inflation during the early Summer is back in the limelight. The prices on used cars have started surging again and we need to pencil in material new spikes in the yearly pace of prices according to our model which also takes the Mainheim indicator into consideration. We project that the used vehicle component will contribute with >1.5% by year-end, with risk to the upside.

Prices on used cars are re-accelerating

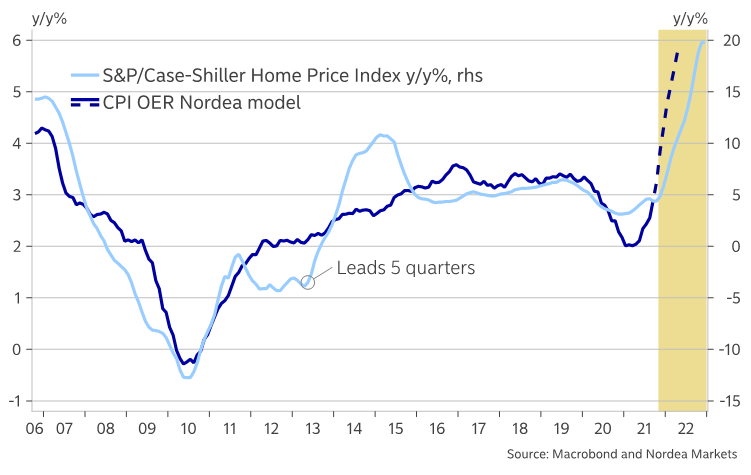

The rent of shelter component is also slowly but surely adapting to the new price level of the housing market. Our model predicts YoY price growth just below 6% in the owners equivalent rent of resident (OER) component over the coming two quarters. Given our model predictions, the yearly contribution to core inflation from the OER component could be as large as 1.7%. Usually there is a time-lag between an increase in house sales prices before the effect shows in the rent of shelter component, and this lag-time has been prolonged by the eviction moratorium. Our findings are broadly in line with the findings of others, including Fannie Mae, who recently updated their home price growth forecast by 2.3%-points to 7.4% in 2022, as well as the Dallas Fed, whose economists project OER inflation to print at 6.9% by 2023, but the difference is that our models front-load this effect substantially compared to Fannie Mae and Dallas Fed. Also this category carries upside risk to the inflation print.

Our models hint of 5-6% rent of shelter inflation already during Q1-Q2 in 2022

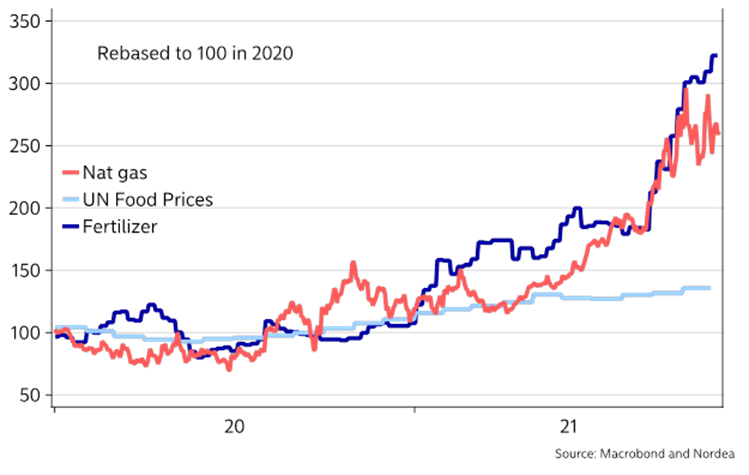

There is a negative feedback loop ongoing in food prices as higher energy prices lead to higher prices on fertilizers and ultimately higher prices on crops and food in general. The energy crisis is far from being over as Russia is still not delivering any gas via the Mallnow station at the Polish/German border (or else Poland keeps it in Poland). This is the exact week Putin promised to start filling the German underground storages from. Can we take him at face value? We doubt it.

The negative price feedback loop from energy to food prices

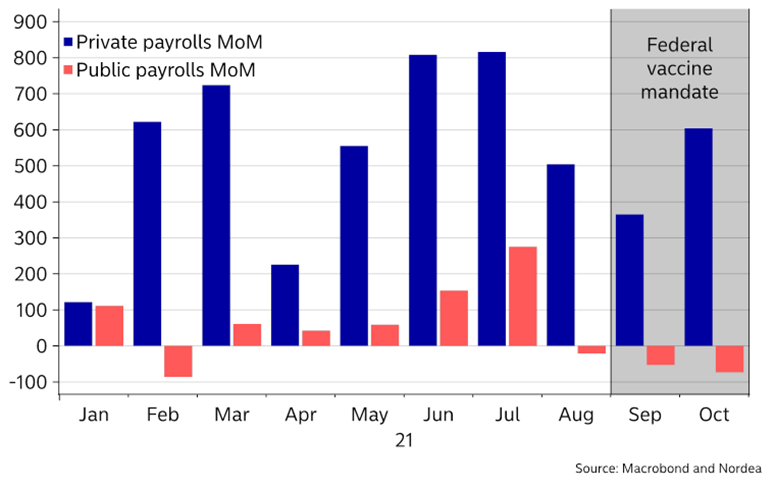

Vaccine mandates likely continue to distort the non-farm reports in the US as well. We have seen negative job growth in the public sector ever since the Federal vaccine mandate was implemented in early September, likely driven by homeschooling, restrictions in services, such as the leisure and hospitality sectors and a lack of labour supply due to vaccine mandates among other things. This is wage inflationary, while continued restrictions in Europe and the US will keep consumption of goods elevated versus services, which is a key reason behind distressed supply chains.

Vaccine mandates are negative for the labor supply and hence inflationary (000s)

Chart 1: Supply delays push costs higher

In the first instance, already-widespread supplier delays became even more common during October. The incidence of delays and shortages surpassed anything seen in almost a quarter century of survey data history. These shortages fed through to yet another increase in firms’ costs, which rose across manufacturing and services in October at the fastest rate seen for 13 years. Only during the oil price spike of 2008 have higher cost pressures been faced by businesses worldwide.

Chart 2: Higher costs passed on to customers

These costs are being passed on to customers at rates unprecedented in the PMI survey history. The Global PMI’s selling price index hit an all-time high of 60.3 with record highs seen for both goods and services. These indices were first compiled in 2009.

Chart 3: Consumers hit by higher prices

While the steepest rate of selling price inflation was recorded globally for intermediate goods (i.e. components sold to other companies), selling prices for consumer goods and investment goods (such as machinery) also rose at the steepest rates recorded since comparable data were available in 2009.

Rising costs also fed through to higher charges levied for all major types of service, with business services reporting the third-highest increase on record and an all-time high reached for consumer services. Prices charged for financial services meanwhile showed the second-highest price rise on record, linked in part to higher borrowing costs.

Chart 4: Business costs to feed through to CPI

Note that, over the past 14 years, the PMI input cost index has exhibited a 79% correlation with global consumer price inflation, with the PMI acting with a lead of three months. With the latest official data showing consumer prices rising globally at an annual rate of 4.3%, its highest for a decade, the PMI suggests this could approach 5% in the coming months.

Chart 5: US sees steepest price increase

Inflationary pressures were most marked in the developed world, where collectively the PMI surveys indicated by far the steepest increase in average selling prices for goods and services recorded since comparable data were first available in 2009. Goods and services prices both rose at unprecedented rates across the developed markets. However, emerging market selling prices also rose sharply on average, the rate of inflation hitting the second steepest seen over the past decade during October. Charges rose at accelerated rates for both emerging market goods and services, the latter’s rate of inflation notably approaching an all-time high.

Looking at the major economies, the highest rate of selling price inflation was seen in the US followed by the UK and then the eurozone, all of which saw series record highs for the PMI Output Prices Index covering goods and services. Selling price inflation in Japan meanwhile accelerated to the highest for just over three years and lifted higher in China to the second-highest for over a decade.

- When will supply chain frictions and input shortages abate? Expect disruptions to last well into 2022, which will result in higher trending goods inflation and production hiccups dampening the recovery in production

(…) Although most economic indicators have come off their historically high levels over the last couple of weeks, global demand for goods remains strong and is adding to already enormous backlogs for industry. What’s more, with some of the busiest shopping days of the year coming up (Black Friday, Cyber Monday and Single’s Day in November, followed by the Christmas season and Chinese New Year in February), the pressure will remain on. Furthermore, shortages are causing hoarding behaviour among businesses and consumers, leading to excess demand and further supply chain pressures.

(…) Although we might have hit a peak of upward momentum in trade as indicated by the latest WTO goods barometer – with the forward-looking new export orders index slowing from 114.8 to 109.3 – the gradual normalisation of international transportation will take months not days, explaining why supply frictions will last well into 2022.

With demand remaining high from the numerous festivities, culminating in the Chinese New Year (February 1 to February 7, 2022), and bottlenecks unlikely to be solved on short notice, we expect some relief to set in from early February. During the Chinese New Year, all factories will shut down eventually so goods supply coming from China will be limited, meaning that orders around the world can be processed without even more supply coming from China. Shipping logistics can at least partially catch up with supply during this period.

In terms of specific shortages, semiconductor shortages are set to remain problematic for quite some time. Setting up new production facilities takes years, while demand continues to be high. This leads us to believe that very tight semiconductor markets will remain in place until 2023. Shortages of chemicals needed for plastics or paint, for example, are also expected to last well into 2022, with many petrochemical plants in the Gulf Region still shuttered for the moment and shipping problems exacerbating current issues. Besides that, a lot of the input shortages are currently exacerbated by the shipping problems, which means that those pressures will persist until shipping issues abate in mid-2022. (…)

Drawing on Koester et al. (ECB bulletin 5/2021), we have created two indices that show underlying trends in early and late pipeline pressures for non-energy industrial goods inflation in the eurozone. The chart below shows that early pipeline pressures are just off historic highs, but that late pipeline pressures are only getting close to record readings. This delay suggests that elevated goods inflation is still to be expected for the months ahead.

Given the current investment in capacity and likely moderation in demand over time, it is likely that this will result in more weakening inflationary or even deflationary pressures emerging from the supply chain over the course of 2023 though.

Pipeline pressures for goods inflation in the eurozone are very elevated

ING Research

Note: index of early pipeline pressures includes Industrial Raw Materials Index, Brent oil in euro, domestic PPI, intermediate goods import prices, and world PPI. The index of later stage pipeline pressures includes the consumer goods PPI, import prices for consumer goods and the nominal effective exchange rate.From a growth perspective, continued disruption for most of 2022 remains a key downside risk to the outlook. Bottlenecks and production shutdowns are set to weigh on GDP growth in most markets, but some more than others. Goods demand is key though, as this has not yet abated despite lead times for orders increasing dramatically in some markets. With new orders still high, expectations are that a continued recovery in GDP is more likely than stagnation.

In Germany, for example, we expect growth to improve in 2022 compared to 2021. The main downside risk is around more drastic production cuts when shortages morph into real bottlenecks. That could lead to more significant output shocks and put the growth recovery at risk. With services still recovering at a fast pace though, there is a solid base under the global growth recovery at the moment, making the supply chain problems more of a fly in the ointment for the outlook right now.

CHINESE COCKROACHES

Bad News: Chinese Property Debt Is Even Higher Than Thought Investors are starting to come to terms with an unpleasant reality in the wake of a missed payment by a Kaisa-backed wealth-management product

Case in point: struggling developer Kaisa’s surprise announcement last week that a wealth-management product it has guaranteed missed a payment. Shares and bonds of Kaisa plunged as a result. Some WMPs backed by Evergrande also failed to pay out on time in September, leading to protests. Such products aren’t necessarily directly issued by developers, but the companies may still be on the hook. And there are few details about them in their financial statements.

Beijing’s push for developers to comply with new leverage benchmarks called the “three red lines” since late last year may have driven companies to shift some debt into more unconventional channels. And such WMPs are far from the only problem.

Another way to obscure debt is through the use of joint ventures. It is common and legitimate to raise money and share risk by selling stakes in property projects to business partners. But the lack of transparency could leave investors guessing how much debt is actually stacked away. The debts of these JVs wouldn’t be included on a developer’s balance sheet if it only owns a minority stake. The developer may still, however, provide loan guarantees. Developers disclose such guarantees in the footnotes as contingent liabilities.

In a report published in June, S&P Global estimated there are 478 billion yuan, the equivalent of $75 billion, of such guarantees by rated Chinese developers, equal to around 9% of their reported debt. Borrowing and lending between JVs and developers further complicates the matter. The cash trapped in the JVs may also not be readily available to repay debt at the parent level. (…)

J.P. Morgan estimated in a report last month that Evergrande’s net debt-to-equity ratio would be 177%, instead of 100% as reported, if all such de facto debt—including commercial paper, wealth-management products and JV guarantees—were included. And, in fact, the actual leverage ratio could be even higher since evidence of some off-balance sheet debts may not be publicly available, the bank said. (…)

- Chinese Junk Bond Yields Top 25% as Property-Market Strains Intensify The surging bond yields, which imply very high default risks, are adding to Chinese property developers’ problems as they face slowing home sales and regulatory curbs on borrowing.

- Evergrande Faces Biggest Payment Test Yet as Grace Periods End

Investors are waiting to see if the embattled developer makes coupon payments totaling $148.1 million for three dollar bonds before the end of 30-day grace periods Wednesday. Evergrande missed the initial interest deadlines last month, Bloomberg-compiled data show. (…)

The developer has so far pulled back from the brink of default by meeting other delayed coupons at the 11th hour before the grace period ended. Some holders of an Evergrande unit’s bond did not receive payment for two coupons originally due Saturday, though both notes have a 30-day grace period. It also has two more dollar coupons due in December. (…)

Fed warns ailing China real estate sector poses risks to US economy Central bank is also monitoring volatility in meme stocks, it says in semi-annual report

Germany’s Economy, Once Europe’s Engine, Is Stalling Germany’s export-oriented businesses have fared poorly in a post-pandemic world of broken supply chains and rising energy prices. The malaise is fueling a debate over whether the German economy needs a reboot and what it should look like.

German manufacturers are struggling to produce cars and factory equipment because of parts and labor shortages. They face surging energy prices that are making sky-high electricity bills even higher. And they must invest hundreds of billions of dollars over coming years to meet new clean-energy standards. (…)

The three parties negotiating a new coalition government following September’s election want to increase public investments, raise wages and streamline planning procedures, which could boost domestic sources of growth and make companies less dependent on foreign demand. (…)

German industrial output and exports began stagnating in 2017, posing a problem for an economy where some 30% of jobs and output are tied to overseas demand, roughly four times the share in the U.S. (…)

A decline in German car production this summer, mainly due to a persistent chip shortage, was the single biggest contributor to the overall drop in industrial output over that period.

German auto production has fallen by more than 50% since 2017, to around 200,000 a month. In the nine months through September, it declined slightly from the year-earlier period, compared with a roughly 10% year-over-year increase in global light-vehicle production over the same period. Germany’s share of global motor-vehicle production fell from about 7% to 5% in the five years through 2020, the data show.

Germany’s automotive industry, by far the biggest in Europe, supports about 800,000 German jobs and accounts for 5% of the nation’s overall economic output. Three-quarters of cars made in Germany are exported.

German manufacturers have invested in electric vehicles, but such vehicles require far fewer parts than traditional ones. (…)

Germany’s net investment rate has been around 0.5% of economic output since the turn of the century, compared with about 1% for Italy and 1.5% for the U.S., according to the World Bank. German net public investment has fallen below zero as existing assets depreciate. (…)

The country’s green-energy transition will require investments of €5 trillion through 2045, or 5.2% of Germany’s annual economic output, on average, every year, according to a study published in October by KfW, the state-owned development bank. That is considerably more than the roughly €2 trillion spent reunifying West Germany with the formerly communist East Germany in the two decades after 1990.

“Germany’s entire business model is at stake,” said Oliver Bäte, CEO of German financial-services group Allianz SE. “If we get energy transition wrong, our economic core gets into trouble and an economic crisis becomes inevitable.” (…)

Government bureaucracy costs German firms about €55 billion a year, roughly half the total amount invested in research and development, according to Germany’s federal statistics agency. (…)

“We have very high labor costs, very high energy costs, and in the last five years, we have seen an enormous increase in bureaucracy,” said Mr. Wolf. “Germany might soon be the sick man of Europe again.”

- As Pandemic Rebounds Across Europe, Germany Hits Record Covid-19 Tally Germany’s recent success in fending off the virus left many people without natural immunity, a possible factor contributing to the current surge across the continent.

(…) Germany and some of its smaller Central and Eastern European neighbors stand out with a far steeper rise in infections than neighboring France, Italy and Spain. Germany registered over 37,000 new cases on Friday, the highest daily number on record, according to government figures, as the seven-day incidence of coronavirus rose to over 200 in 100,000 people.

Experts blame Germany’s figures on the German population’s relatively low exposure to the virus after the country dodged a summer swell of infections that afflicted its Western and Southern neighbors. That resulted in low natural immunity among the population.

Other factors playing a role include a comparatively low rate of vaccination, the slow rollout of booster shots to high-risk groups as well as lower temperatures that are dragging people indoors. (…)

Over 67% of the German population have been fully vaccinated, and experts say this is helping to keep hospitalizations and deaths below their level during previous case surges. The seven-day rolling average of deaths linked to Covid-19 rose to 118 on Sunday, much lower than the record 894 in January but significantly more than the average in recent months. (…)

Health Minister Jens Spahn said last week that around 50% of care personnel—including those tending to the elderly and other risk groups—were unvaccinated, but that he was reluctant to make vaccinations mandatory for them for fear that they could stop coming to work. (…)

Most if not all people who are neither vaccinated nor had the virus will likely become infected in the next months, according Dr. Andreas Gassen, head of the country’s National Association of Statutory Health Insurance Physicians. (…)

Around 26% of intensive-care patients infected with Covid-19 have been fully vaccinated, while that figure rises to over 34% for patients older than 60, according to the Robert Koch Institute. The institute said the so-called breakthrough infections were by far most common in those vaccinated with Johnson & Johnson’s one-dose shot.

Around 40% of people older than 60 had no neutralizing antibodies against the Delta variant of coronavirus six months after becoming fully vaccinated, according to Prof. Leif Erik Sander, a vaccine expert at the Charité University Clinic in Berlin. (…)

“Many citizens may not have understood that the vaccine is primarily for protecting from severe disease and death, not for preventing infection,” he said. (…)

-

Denmark plans to reintroduce some curbs to halt the recent spike in Covid-19 cases there.

-

A Texas Department of Health Services study found that unvaccinated people are 20 times more likely to perish from the virus.

-

Regeneron’s Antibody Drug Cut Risk of Covid by 82% Data suggest potential use for drug as a prophylactic for the immunocompromised or others who aren’t well protected by vaccination

EARNINGS WATCH

Via Bespoke:

- Clorox (CLX) CFO Kevin Jacobsen commented, “We now project that transportation costs will remain elevated. (…) We’re facing an even tougher cost environment than previously expected. (…) we plan to take additional actions, including more pricing, resulting in increases to about 70% of our portfolio.”

- Johnson Controls (JCI) CFO Olivier Leonette added, “we do expect supply chain constraints and the inflationary environment to continue at least over the next couple of quarters. (…) The inflated level of pricing will result in margin headwinds”.