Gasoline price surge hits broader US spending

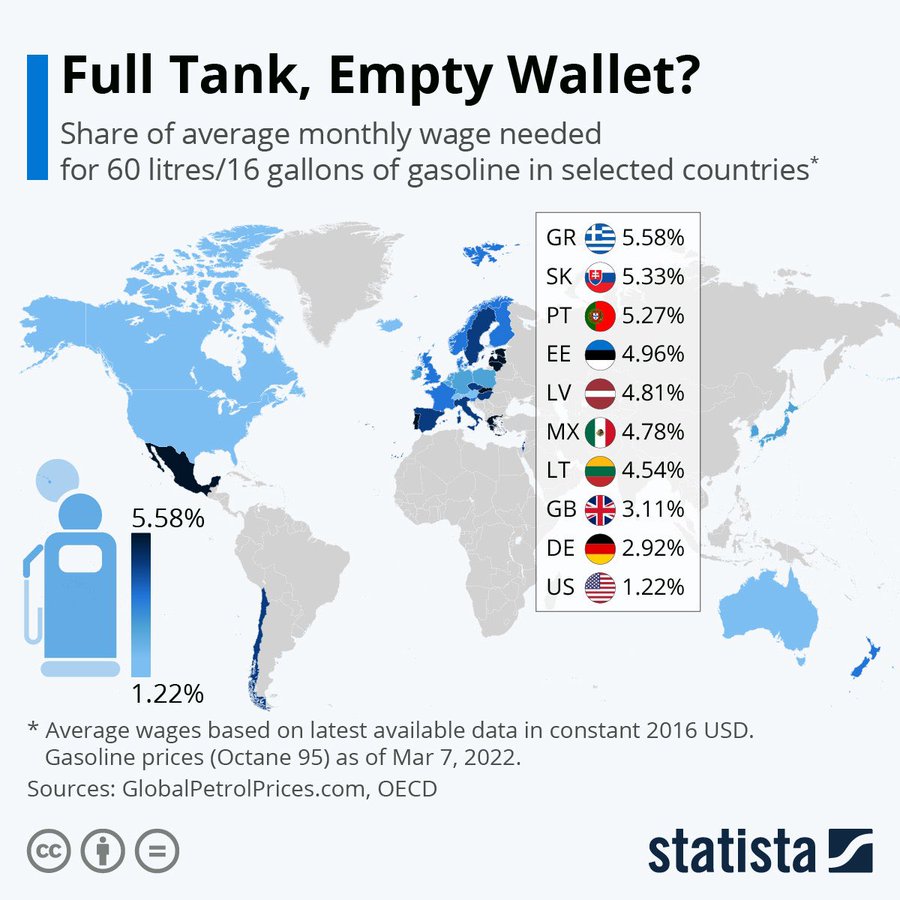

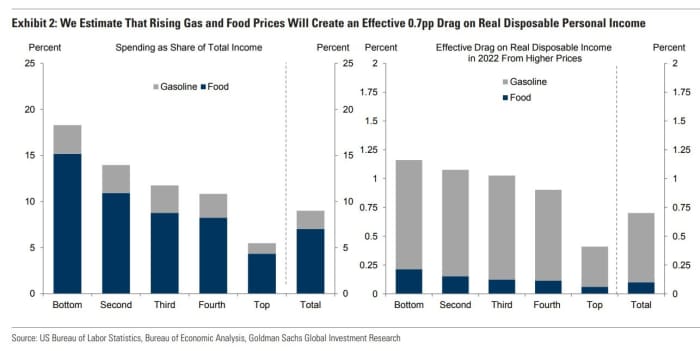

The US consumer started the year strongly, spending with more exuberance than initially thought in January. However, gasoline prices are rising sharply, which leaves less cash in consumers’ pockets to spend on other goods and services. Household consumption could become a drag on economic growth in the coming months unless pump prices drop quickly.

US retail sales rose 0.3% month-on-month in February, a little below the 0.4% consensus. However, January’s already huge 3.8% jump has been revised up to 4.9% as shoppers returned with greater vigour than originally thought after the Omicron wave depressed spending in December.

The “control” group, which excludes volatile components such as auto dealers, food service, building materials and gasoline, and has a stronger correlation with overall consumer spending patterns, fell 1.2% month-on-month, but this is versus an upwardly revised growth rate of 6.7%. Consequently, we can safely say that the consumer sector has started the year on a very firm footing and likely means some upward revisions are required to first-quarter consumer spending forecasts.

The details of the February report show gasoline was the main positive contributor (rising 5.3% month-on-month) on higher prices. Excluding gasoline, retail sales fell 0.2% with the main weakness in furniture (-1%), electronics (-0.6%)and non-store retailers (-3.7% ). Decent gains were seen in clothing (1.1%) and sporting goods (1.7%). The chart below shows a more detailed breakdown of the path of components.

Looking ahead, the March report will show an even more marked divergence between gasoline station sales and non-gasoline. Surging gasoline prices – the national average for gasoline is currently $4.30/gallon versus an average of $3.50 in February – will leave less cash in the pockets of consumers to spend on other goods and services. This will weaken household consumption’s contribution to GDP growth in the second quarter so we have to hope that the 25% fall in oil prices seen in the past week will quickly translate into lower pump prices.

That said, rising wages and employment will boost incomes, while the build of household savings provides a solid backstop that can keep consumers spending. Consequently, we are thinking it will be more of a slowdown rather than an actual contraction story.

On balance though, the US consumer started the year very strongly, and in an environment of strong jobs growth and 40-year highs for inflation, this fully justifies a series of rate hikes from the Federal Reserve, starting today.

On a MoM basis, control sales are up 4.1% annualized in the last 3 months and 4.0% in the last 4.

But headline CPI is up 8.2% annualized in the last 3 and 4 months.

In real terms, the picture is very different: last 3 months -4.1% a.r., last 4 months: -4.3%.

For Q1’22, January provides a strong start (first 2 months +27.3% a.r.) but March could be hit hard by the 20-25% jump in gas prices which, in itself, will reduce discretionary income by 2.0-2.5% MoM.

- Shoppers Reach Their Limits on Some Price Increases Efforts to charge more for certain items from sofas to T-shirts have met resistance; ‘there was a revolt.’

(…) Macy’s Inc. M 7.76% tried to raise prices on some mattresses and sofas by $100, but shoppers pushed back, Chief Executive Jeff Gennette said. Clothing brand Bella Dahl raised prices on its T-shirts by about $20, then sales fell and the company rolled back the price increase. “There was a revolt,” said Steven Millman, its chief brand officer. “If we go any higher, we’ll do half the sales.” (…)

In apparel, there is “some trading down with more shoppers turning to value players for some of their purchases,” according to Neil Saunders, a GlobalData managing director. “This is likely in response to squeezed budgets.”

Unit sales of general merchandise goods such as apparel, footwear, toys and sports equipment declined in nine of the 10 weeks from Dec. 26 through March 5 compared with the same period a year ago, according to market research firm NPD Group.

Roughly 43% of consumers surveyed by NPD in February said that if prices continue to rise, they will delay less-important purchases to stick to a budget. (…)

Luxury players have been jacking up prices with no visible collapse in demand. Items that are scarce because of supply-chain shortages also can command higher prices. And shoppers are more willing to pay up for fashion items like spring dresses than basic T-shirts, executives said. (…)

The Chase card spending tracker, through March 11, sees control sales down 0.3% in March, in nominal dollars. Spending in restaurants is down 3.4% so far in March.

Business Leaders Survey: Covering service firms in New York, northern New Jersey, and southwestern Connecticut

Business activity perked up in the region’s service sector, according to firms responding to the Federal Reserve Bank of New York’s March [2-9] 2022 Business Leaders Survey. The survey’s headline business activity index jumped eighteen points to 18.3. The business climate index came in at -23.3, indicating that firms

generally viewed the business climate as worse than normal for this time of year. Employment levels continued to grow modestly, and wages again rose at a swift pace.

The prices paid index remained near record levels and the prices received index hit a fresh record high. Optimism about future conditions dropped sharply.

Services inflation remains strong:

Fed Raises Interest Rates for First Time Since 2018 Officials signal quarter-point increase will be followed by six more this year to combat inflation

Officials signaled they expect to lift the rate to nearly 2% by the end of this year—slightly higher than the level that prevailed before the pandemic hit the U.S. economy two years ago, when they slashed rates to near zero. Their median projections show the rate rising to around 2.75% by the end of 2023, which would be the highest since 2008. (…)

Seven officials projected the Fed would need to raise rates above 2% this year, a level that would require at least one of their moves this year to be a half-percentage-point increase, which the Fed hasn’t done since 2000. (…)

“As I looked around the table at today’s meeting, I saw a committee that’s acutely aware of the need to return the economy to price stability and determined to use our tools to do exactly that,” said Fed Chairman Jerome Powell at a news conference on Wednesday that followed the Fed’s first fully in-person meeting in two years. (…)

“That’s a very, very tight labor market—tight to an unhealthy level, I would say,” he said. (…)

Mr. Powell said that the Fed could finalize a plan to shrink its $9 trillion asset portfolio at its next meeting, May 3-4, and to implement it shortly afterward. The central bank ended a long-running asset-purchase stimulus program last week. (…)

During the presser, M. Powell made very clear that:

- The Fed’s dual mandate on employment and inflation prioritizes containing inflation in order to meet the employment objectives.

- The FOMC is totally focused on keeping inflation expectations anchored at 2%.

- The FOMC will use its tools (i.e. interest rates) to achieve its goals.

- In reality, they do not know how inflation and wages will behave so they will constantly adjust to evolving circumstances.

John Authers in The Day the Fed, Putin and Xi Threw in the Towel:

(…) Only three months ago, no FOMC member thought that rates could go beyond 2.25% by the end of next year. Now, almost all of them think that rates will go at least that far, and a couple believe rates will go as high as 3.75%. It’s arguably the biggest shift from one meeting to the next in the decade that the Fed has been publishing dot plots.

In addition to giving up on “lower for longer” rates, the Fed also seems to be capitulating on its forecasts for inflation to come under control relatively swiftly. (…)

These inflation estimates are, obviously, much higher. Perhaps more shockingly, they are all over the place. This year has nine months to run, and yet the spread of estimates for inflation at the end of it covers almost two percentage points. There is no consensus. That is alarming, and prompted some to fear that the Fed was admitting it didn’t know what was going on. (…)

Powell was focused like a laser beam on convincing the world that he was prepared to hike, hike and hike again to beat inflation. (…)

Euro-Area Inflation Climbs Faster Than Expected on Energy Surge

Consumer prices surged 5.9% last month, according to Eurostat data published Thursday, with energy prices up 32% from the previous year. (…) A separate release showed the euro area’s job vacancy rate rose to 2.8% in the fourth quarter, in a sign that companies may increasingly be struggling to hire staff.

Brazil’s Central Bank Raises Benchmark Interest Rate to 11.75%, Signals More Tightening

Foxconn Forecasts Tough Operating Environment From Pandemic, Inflation, War The iPhone assembler resumed some production in Shenzhen by setting up a bubblelike environment and keeping workers inside.

Kremlin Denies Report of Major Progress in Talks

- Putin Acknowledges Impact of Sanctions on Russian Economy Russia has seen factory closures, job losses, a doubling of interest rates and a decline of the ruble

(…) “Our economy will need deep structural changes in these new realities, and I won’t hide this—they won’t be easy; they will lead to a temporary rise in inflation and unemployment,” Mr. Putin said in televised remarks on Wednesday before a video meeting with Russian government officials. (…)

Mr. Putin pledged to carry out a raft of measures to offset the pain of the sanctions on Russians, including increased payments to pensioners and state employees, a hike in the minimum wage and financial assistance to businesses. The purchasing power of ordinary Russians has been deeply eroded after Western sanctions triggered a sharp devaluation of the ruble.

But Mr. Putin stopped short of endorsing Soviet-style price controls. He also said Russia’s central bank wouldn’t resort to printing money to meet the government’s spending needs. (…)

“Now everyone knows that financial reserves can simply be stolen,” Mr. Putin said. He called the freezing of Russia’s central-bank assets illegitimate and warned it would lead countries around the world to store their reserves in tangible assets such as gold, land and raw materials instead of financial assets. (…)

During the video meeting with Mr. Putin on Wednesday, the leader of Russia’s Tatarstan region said production at truck maker Kamaz, which employs tens of thousands of people in his region, could fall by 40%.

Russia could also be on the cusp of defaulting on its debt for the first time since 1998. The Russian government was required to pay $117 million in interest payments on two dollar-denominated government bonds Wednesday. Russia’s finance minister said the payment had been made and appeared to be tied up at the U.S. bank where Moscow holds its dollars. The U.S. Treasury Department countered that sanctions didn’t prevent Russia from servicing its debt. (…)

China plans audit concession in face of US delisting threat

Covid-19 Admissions Near a Low, but Risks Loom Countervailing trends of declining U.S. Covid-19 hospital admissions and rising cases in the U.K. complicate the outlook for the pandemic’s trajectory

(…) Counts of newly admitted Covid-19 patients in U.S. hospitals are nearing their lowest recorded level after any prior surge. The seven-day average for patients with confirmed and suspected Covid-19 cases admitted to hospitals slid to 6,406 by Wednesday, down from a record high that topped 28,000 in January, a Wall Street Journal analysis of federal data shows. (…)

But U.S. health experts are watching rising Covid-19 caseloads in parts of Europe. The U.K. is of particular concern because trends there have tended to presage those in the U.S. The spread of the BA.2 Omicron variant and the relaxation of Covid-19 precautions—two factors also present in the U.S.—might be driving up Covid-19 there, according to public-health experts. Research indicates that BA.2 is a yet more infectious version of the virus.

“Our experience with Delta and Omicron is that what happens with Europe doesn’t stay in Europe; it hits us,” said Jay Varma, a physician and epidemiologist who directs Weill Cornell Medicine’s Center for Pandemic Prevention and Response. (…)

U.K. data show that while cases and hospitalizations have risen, the number of patients requiring ventilators has remained low. The U.K. Health Security Agency estimated in March that BA.2 represented more than four of every five known Covid-19 cases in England.

The CDC this week estimated that BA.2 recently represented about 23% of U.S. cases, far behind the U.K., but on the rise for several weeks. The estimate climbed to 39% in a region that includes New York and New Jersey, two of many states that recently lifted masking mandates as the winter surge retreated. (…)

Case data in the U.S. have become less reliable because of the rise in at-home testing, which generally isn’t captured in state case counts, and some states have dialed back on the frequency of their reporting. (…)

Cases are also rising strongly in Germany, France, South Korea, just to name a few.