Why a Soft Landing Could Prove Elusive Odds of the Fed reducing inflation without a recession have improved, but hazards loom

On the eve of recessions in 1990, 2001 and 2007, many Wall Street economists proclaimed the U.S. was on the cusp of achieving a soft landing, in which interest-rate increases corralled inflation without causing a recession.

Similarly, this summer’s combination of easing inflation and a cooling labor market has fueled optimism among economists and Federal Reserve officials that this elusive goal might be in reach.

But soft landings are rare for a reason: They are tricky to pull off. “You need a lot of luck,” said Antúlio Bomfim, a former adviser to Fed Chair Jerome Powell who is now at Northern Trust Asset Management. (…)

The goal faces four threats: the Fed holds rates too high for too long, economic growth accelerates, energy prices rise or a financial crisis erupts.

“The Fed could temporarily achieve a soft landing, but I’m skeptical that it could stick the landing for very long,” said Peter Berezin, chief global strategist at BCA Research in Montreal.

Once the economy is operating with little or no slack, anything that boosts demand could stoke inflation. Meanwhile, anything that lowers demand could send the unemployment rate rising, a process that is hard to stop once it starts, said Berezin. He expects a recession in the second half of next year. (…)

Since World War II, economists say, the U.S. has achieved only one durable soft landing, in 1995. “We steered the economy very expertly, but in addition, we were lucky. Nothing bad happened,” said Alan Blinder, an economist who was Fed vice chair from 1994-96. (…)

Nick Timiraos lists the 4 scenarios, to which I add my two-cents:

- The Fed stays too tight: “Officials have indicated they will hold rates at high levels for longer than they might have before the recent inflation spell to ensure price pressures don’t resurge.” The “high for longer” scenario, highly data and judgement dependent. Like a high wire act with limited visibility.

- The economy stays too hot. “Second, consumer spending and business activity are showing signs of accelerating again after slowing last year. If that continues, Fed officials could conclude that inflation’s decline risks stalling out unless they raise rates higher, increasing the chances of a recession.” The “higher for longer” scenario. I also call it “growthflation” thanks to a wealthy and employed consumer demanding that growing companies boost their wages to offset inflation.

- Energy prices take off. “Third, rising oil prices threaten to drive inflation higher while reducing growth by slowing discretionary spending.” The “stagflation” scenario which also comes with stubbornly rising wages. The worst, since the Fed has little control on the initial cause: reduced supply. Sole solution: kill demand.

- A financial-market mishap. “Fourth, the economy could be hit by some market crackup or geopolitical crisis. Many analysts see the rapid adjustment in global borrowing costs and the lagging effects of past increases as a source of instability.” A grey or black swan scenario cause by continued financial strains or any of the above scenarios.

Against these all-bad scenarios, the “Goldilocks” world looks very appealing, even if it rarely happens…Can it really occur with central bankers trying to navigate the unknown territory they created post GFC, a war in Ukraine and other geopolitical issues, China’s challenges and a hawkish OPEC+?

North America is a comparatively serene “island”, benefitting from some of the world’s problems. It has strong currencies, wealthy consumers and a powerful central bank. It is also energy independent and technologically strong with high productivity potential.

But, companies in the S&P 500 index, which captures about 82% of the total U.S. equity market value, derive a lot of their revenues from foreign markets. Actually, a 2022 research by Global X concluded that “Roughly 40% of S&P 500 revenues are generated outside of the U.S., and about 58% of Information Technology company sales were sourced from abroad.”

S&P Global has a “S&P 500 U.S. Revenue Exposure Index” (SPXREUP) designed to measure the performance of companies in the S&P 500 with higher than average revenue exposure to the U.S.. Its 252 constituents account for 38% of the total S&P 500 market cap as of August 2023.

S&P Global has a “S&P 500 U.S. Revenue Exposure Index” (SPXREUP) designed to measure the performance of companies in the S&P 500 with higher than average revenue exposure to the U.S.. Its 252 constituents account for 38% of the total S&P 500 market cap as of August 2023.

That index has substantially underperformed the S&P 500 Index over any period in the past 10 years. Year-to-date (to August 31), its total return is only 1.7% against +18.7% for the S&P 500.

Just so you know about this “island of tranquility”.

UAW Strike Ripples Across Industry as Automakers Plan Temporary Layoffs General Motors said it would soon idle a plant in Kansas because of a resulting parts shortage, while Ford plans to temporarily lay off about 600 workers.

(…) In Canada, rather than negotiating with all three major automakers at once, Unifor selected Ford as the “target” company for bargaining. A collective agreement with Ford, once ratified, will set the pattern for contracts with GM and Stellantis.

Talks with Ford began in August and the union has rejected two offers from the automaker. The contract expires at 11:59 p.m. on Monday and Unifor members voted almost unanimously in support of a strike if an agreement isn’t reached. (…)

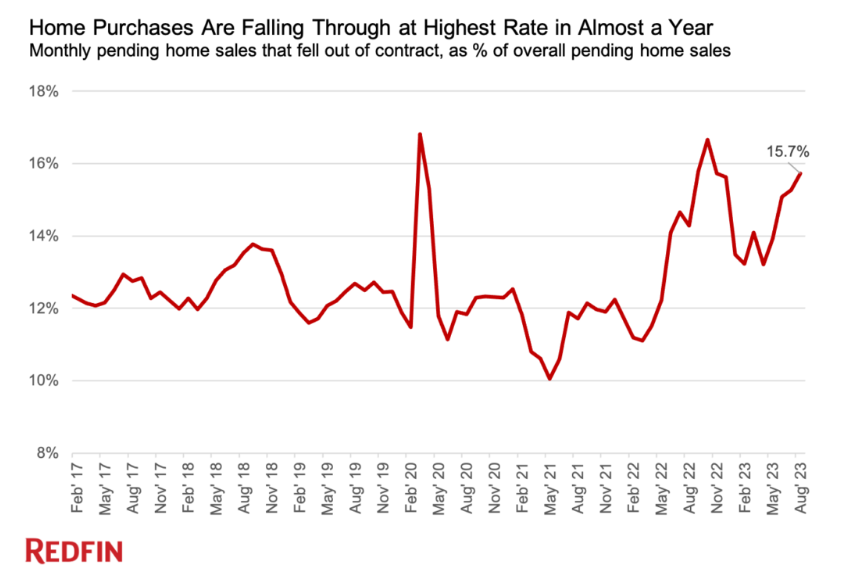

US Homebuyers Cancel Purchases at Highest Rate in 10 Months About 16% of contracts were scrapped in August, Redfin reports

Nearly 60,000 deals to purchase homes fell through in August, according to a report released Friday by Redfin Corp. That’s equal to roughly 16% of homes that went under contract last month, the biggest share of cancellations since October. (…)

“I’ve seen more homebuyers cancel deals in the last six months than I’ve seen at any point during my 24 years of working in real estate,” Jaime Moore, a Redfin agent, said in the report. “They’re getting cold feet.” (…)

US retailer holiday hiring to drop to levels last seen in 2008

U.S. retailers will hire the lowest number of seasonal workers for this holiday season since 2008, due to increased labor costs and shaky consumer confidence, according to a report by Challenger, Gray & Christmas provided exclusively to Reuters.

Retailers are expected to add just 410,000 seasonal jobs this season, according to an analysis of nonseasonally adjusted data from the Bureau of Labor Statistics (BLS) by the global outplacement and executive coaching firm. That is just slightly above the 324,900 workers they added during the last quarter of the financial recession of 2008.

U.S. retailers added 519,400 jobs in the last quarter of 2022, a 26% decline from the same period in 2021. (…)

U.S.-based companies have so far announced just 8,000 planned hires for the holiday season, compared with the 258,201 planned hires announced by employers by this point in 2022, according to Challenger, Gray & Christmas’ tracking.

“We have never gone this far into September and not had big hiring predictions from retailers,” said Andrew Challenger, senior vice president at Challenger, Gray & Christmas. “It’s really surprising”, he said adding that it signals uncertainty and lower seasonal hiring trends this year. (…)

Holiday sales in the United States are estimated to grow at their slowest pace in five years, according to a report released on Wednesday, as dwindling household savings and worries over the economy prompt consumers to spend judiciously.

Sales across physical stores and online channels are expected to rise by 3.5% to 4.6% between November and January, for a total of $1.54 trillion to $1.56 trillion, according to Deloitte.

That compares to a 7.6% increase in 2022, Deloitte said, when high inflation drove up prices for everything from Christmas cardigans and toys to home appliances. (…)

Actually, there is no slowdown in real terms, quite the opposite: my “retail inflation” index (35% CPI-Durables + 65% CPI-Nondurables) was up 11.0% in 2022 when total retail sales rose 9.7% (per PCE data, real expenditures on goods declined 0.5% in 2022).

In the first 6 months of 2023, “retail inflation” was 1.8% vs total sales up 3.2% (real expenditures on goods rose 1.1%). Averaging July and August: “retail inflation” was +0.1% vs retail sales +2.6%.

From The Transcript:

- “In the US, things are better than I would have expected them to be when we started the year. I was concerned about the amount of inflation in categories like dry grocery and consumables, and how that would impact discretionary purchases. Had an eye on the consumer balance sheet, all those things that we were all thinking about at the beginning of the year. But things have held up better than I would have guessed.” – Walmart (WMT ) CEO Douglas McMillon

- “From a macro standpoint, I think what we’re seeing is consistent with what you’re hearing from other banks, which is the consumer remains strong” – US Bancorp (USB ) CEO Andrew Cecere

- “I mean, what we see from a consumer standpoint is that the consumer continues to be resilient. They continue to be spending on travel, they continue to be spending on experiences even as we look at the data through the end of August. .” – Mastercard (MA ) CFO Sachin Mehra

- “They have more money than they’ve had. Home price has gone up for the last 15 years. Asset prices have gone up. Their balance sheet is in great shape. Their incomes have gone up. They’ve got more cash in their checking accounts than pre-COVID. It was a lot more, and it’s been coming down so that excess — we call it excess savings seems to be normalizing. Wages are going up, particularly at the low end. It’s pretty good, which is why you have a pretty good economy.” – JPMorgan Chase (JPM ) CEO Jamie Dimon

- “But putting all of that together, I think the consumer is really solid position. It’s been strong. We see credit normalizing as we would expect. But overall, again, the consumer is looking pretty good.” – Capital One Financial (COF ) CEO Andrew Young

- “…they are in good shape and they’re angling down. They’re spending a little bit of it, but they still have on the lower-end probably two to three times more cash than they had pre-COVID.” – Bank of America (BAC ) Regional President Dean Athanasia

- “So broadly, the consumer is still pretty strong. They carried over some savings from COVID that are still on their balance sheets, and their credit scores are still above 2019, which is a good sign. So when we look forward, that’s a real positive.” – Equifax (EFX ) CEO Mark Begor

Did you miss The Wealth Defect?

El-Erian Warns of ‘Massive’ Corporate Refinancing Next Year

“If you look at high yield, if you look at commercial real estate, there’s massive refinancing needs next year. Massive,” he said on Bloomberg Television Friday. “So that’s the point of pain which starts to happen.”

“There are things that have to be refinanced in this economy that cannot be refinanced in an orderly fashion at these rates,” according to the chief economic adviser at Allianz SE and Bloomberg Opinion columnist. (…)

The US junk bond market faces a looming wall of debt coming due over the next few years with $41 billion maturing in 2024 and another $113 billion the following year, Bloomberg compiled data show. (…)

“Now, some people will tell you there’s lots of distressed credit funds with lots of money waiting to come in,” El-Erian said. “We’re going to see a game of chicken between the two.”

Corporate borrowers are coming to terms with the likelihood that Federal Reserve officials will keep interest rates in the US elevated for a protracted period of time, according to Wells Fargo & Co.

Companies are finding ample appetite for new bond sales across both investment-grade and high-yield debt markets — and many executives are taking advantage of that to tap US debt markets, said Maureen O’Connor, global head of high-grade debt syndicate at the bank. That’s as some finance chiefs see signs that elevated borrowing costs are set to linger. (…)

Issuance has been robust this month across both high-grade and junk debt markets, with more than $110 billion of bonds sold globally last week. That’s the busiest start to any September on record, according to data compiled by Bloomberg. (…)

Reuters: “Refinancing is also coming at a higher cost. Junk bond issuers are now paying roughly 100 to 300 basis points more in coupons on new refinanced debt relative to in-place coupons, according to the report. Leveraged loan issuers are paying 60 to 250 basis points more when they refinance their loans.”

(

(